Thermal Generating Asset Valuation

Business Questions

What future monthly revenue should I expect from a particular thermal generating asset or a portfolio of assets, and how uncertain is this revenue?

How much fuel will the generators consume and how much uncertainty is there around this consumption?

How can I reduce my asset’s exposure to volatile market prices by hedging future fuel consumption or power production?

When should I schedule planned maintenance to minimize the financial impact of unit downtime?

How does my asset’s value change under various future market price scenarios?

The Need for Analysis

Operating an electricity generating asset requires an understanding of plant-specific physical and operational characteristics within the context of highly volatile financial markets for power and fuel. Uncertainty in future power and fuel prices, plant outages, and routine daily operation all pose significant risks to future cash flow and threaten an asset owner’s ability to service debt. Prudent planning requires detailed analysis tailored to each individual asset and the market in which it operates.

The ability of a generating asset to ramp production up or down as economic conditions change holds significant value, particularly in volatile energy markets. This “extrinsic” value can only be assessed through rigorous modeling and optimization of asset operation at the hourly or sub-hourly level in relation to simulated prices. Understanding the monetary value of a unit’s flexibility within its particular market requires a robust analytical approach to modeling real-time production coincident with market prices.

An asset’s flexibility is restricted by physical operating limits and operational best practices. Real option valuation breaks down for physical assets when there are limits on cycling and ramping capability, minimum up/down time requirements, efficiency erosion under partial load, and variation in startup costs by downtime. Proper valuation of such operational limitations requires a granular optimization routine that dispatches the unit economically within the context of changing market prices.

The cQuant.io Solution

cQuant’s thermal generating asset valuation approach combines Monte Carlo price simulation with generation dispatch optimization and cash flow reporting to uncover the true operational value of each asset. It optimizes asset dispatch against market prices at the hourly level, accounting for start costs, minimum up/down time constraints, partial load efficiency, and numerous other user-specified plant characteristics.

With robust market price simulation, granular dispatch optimization, and insightful cash flow reporting, cQuant.io helps you paint a complete picture of future value and risk for your portfolio of physical and financial energy assets.

cQuant.io Users Can:

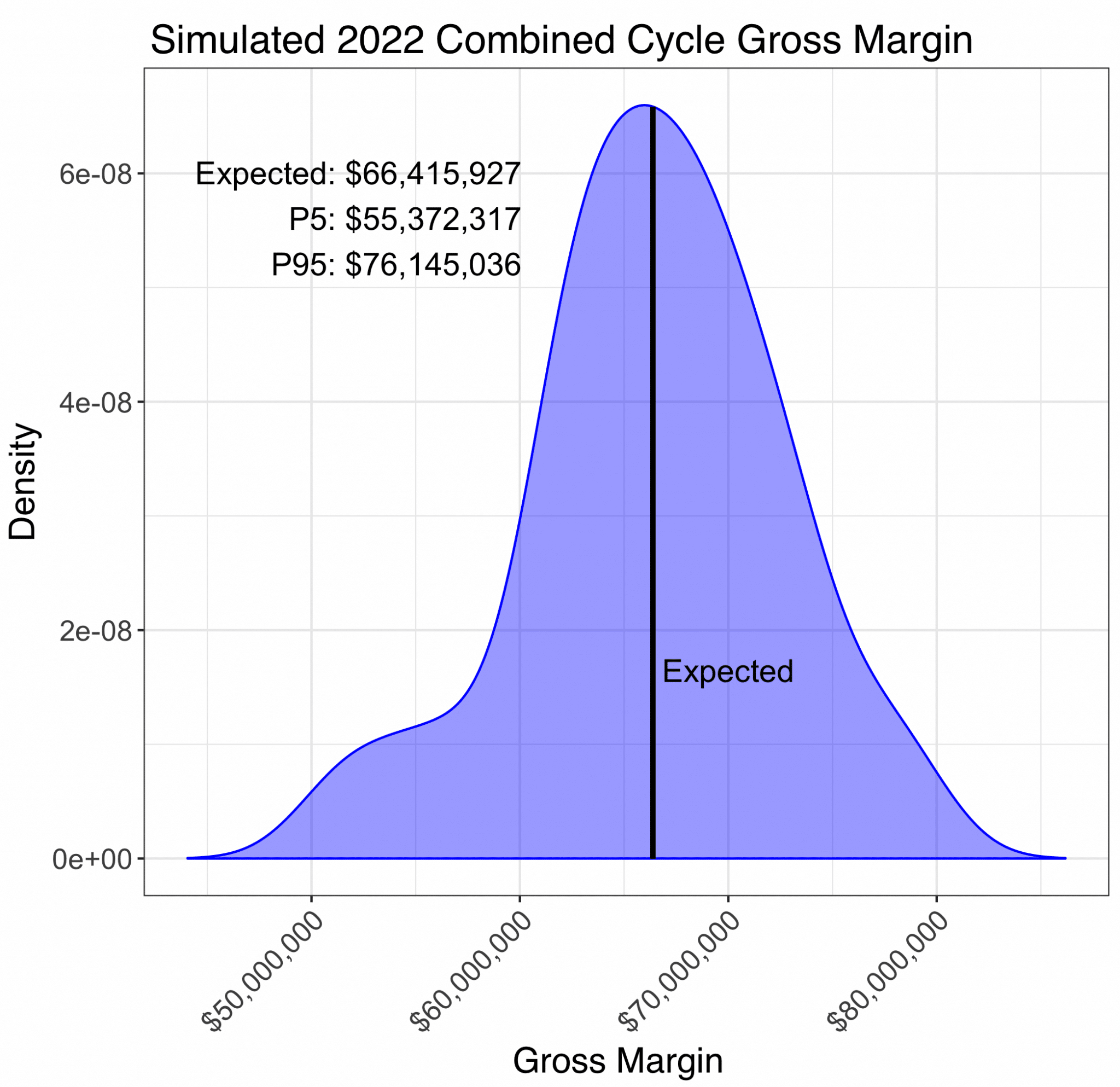

Report expected monthly generation, fuel requirements, and gross margin, as well as uncertainty around the expected value.

Combine physical assets with financial contracts to evaluate portfolio-level risk mitigation strategies and assess hedge effectiveness.

Report monthly and annual cash flow at risk (CFaR) at the portfolio-level and for individual assets.

Easily define scenarios on the future prices of electricity and fuel, and report the resulting impact of each on cash flow and CFaR.

Quickly re-run previous valuation analysis against updated forward market prices to generate mark-to-market reports and track value over time.

Investigate the impact of different planned outage schedules on cash flow and CFaR.