Renewable Project Valuation

Business Questions

How will variations in production and market prices align in real time to drive value for an existing or prospective renewable project?

How can I understand and communicate the true value of a renewable project so I can secure financing?

What risk does my project bear if current assumptions about the future state of the market don’t hold?

How should I hedge my renewable asset to protect against loss of value as market prices evolve?

The Need for Analysis

The non-dispatchable and intermittent nature of renewable generation exposes it to the real-time power markets in a way that is significantly different from more traditional thermal generation assets. While the marginal cost of production is very low for renewable assets due to the lack of fuel requirements, production uncertainty is magnified by the high degree of uncertainty in real-time power prices. This results in significant risk to the value of future generation, leading to difficulties in valuation and securing financing.

Location is also an extremely important value driver for renewable generation facilities. Each potential site not only has it’s own unique solar or wind resource availability, it’s also exposed uniquely to the power market through complex grid topology and transmission constraints. A proper understanding of value must incorporate important location-specific attributes of both the renewable resource and geographically-coincident market prices.

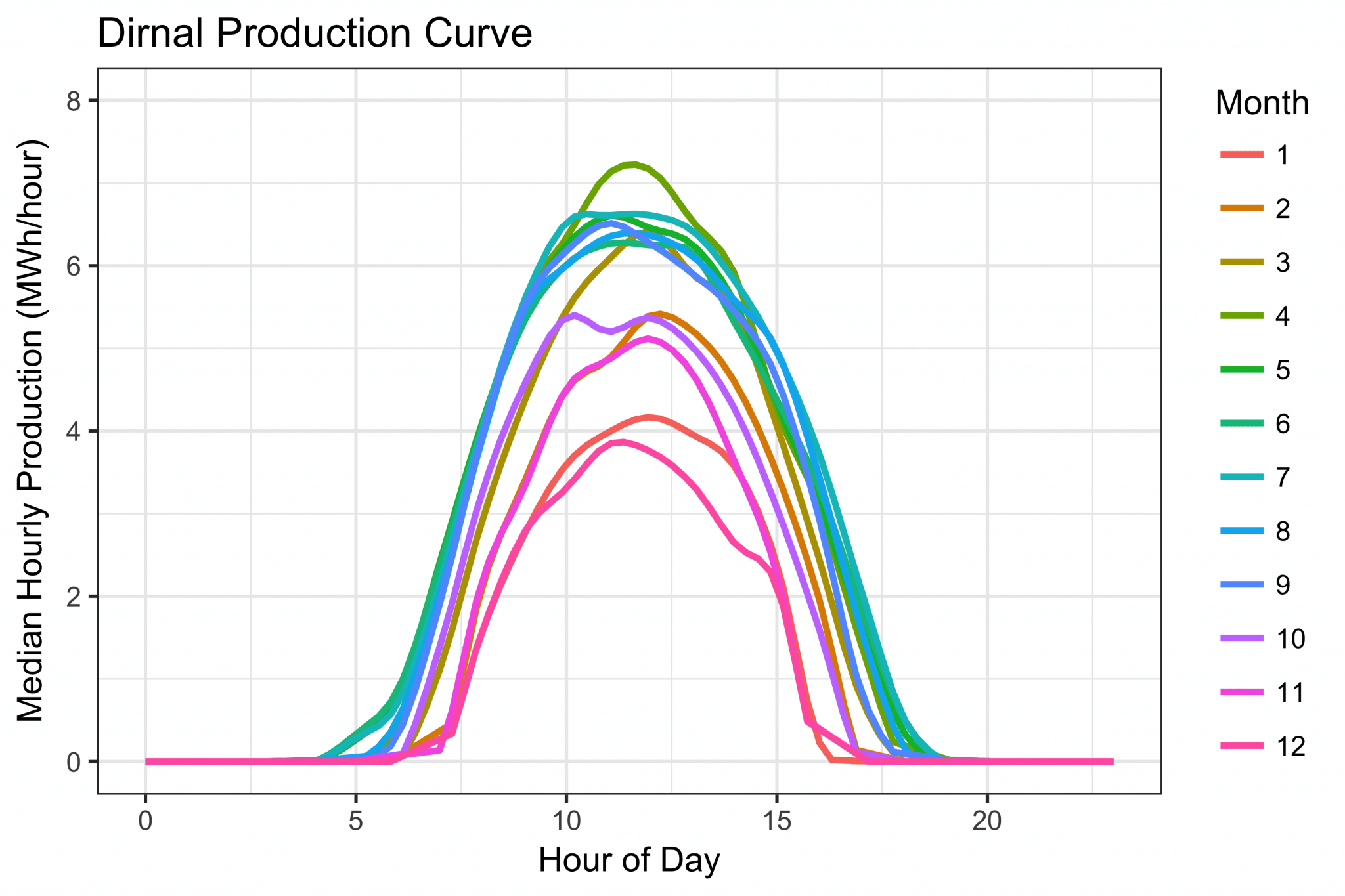

The expected shapes of generation and market prices throughout each day are primary value drivers, as are the ways these shapes change seasonally. However, equally important is the degree of uncertainty around the expected shapes. This too changes hourly and seasonally, and can result in dramatic shifts in a renewable project’s expected production value over the course of each year.

The cQuant.io Solution

cQuant’s ReAssure renewable project valuation framework incorporates the important components of location-specific resource availability and electricity prices at the hourly level to generate a statistically robust view of future production value. Monte Carlo simulations of both generation and prices capture key daily and seasonal trends unique to each project’s location. The simulation-based approach also assigns likelihoods to each potential future value outcome, providing a complete picture of future value and uncertainty.

Assessing the true value of a renewable project requires detailed granular analysis that a provides a location-consistent representation of uncertainty. cQuant.io’s ReAssure advanced renewable analytics framework helps your organization achieve best practices in renewable project valuation to ensure a comprehensive picture of value and uncertainty for your investment.

cQuant.io Users Can:

Report monthly and annual expected future project value and the degree of value uncertainty.

Model individual projects at their specific latitude and longitude coordinates, easily changing project location to investigate geographic variability in renewable resource availability.

Perform scenario analysis on future market prices to identify project-specific risks and inform risk mitigation strategies.

Track project mark-to-market value as expectations around future electricity prices evolve.

Leverage robust modeling results to generate confidence in project value for financing or transfer of ownership negotiations.