Portfolio Cash Flow Reporting & Scenario Analysis

Business Questions

What is the expected monthly cash flow for my portfolio of physical energy assets and financial contracts over the coming years?

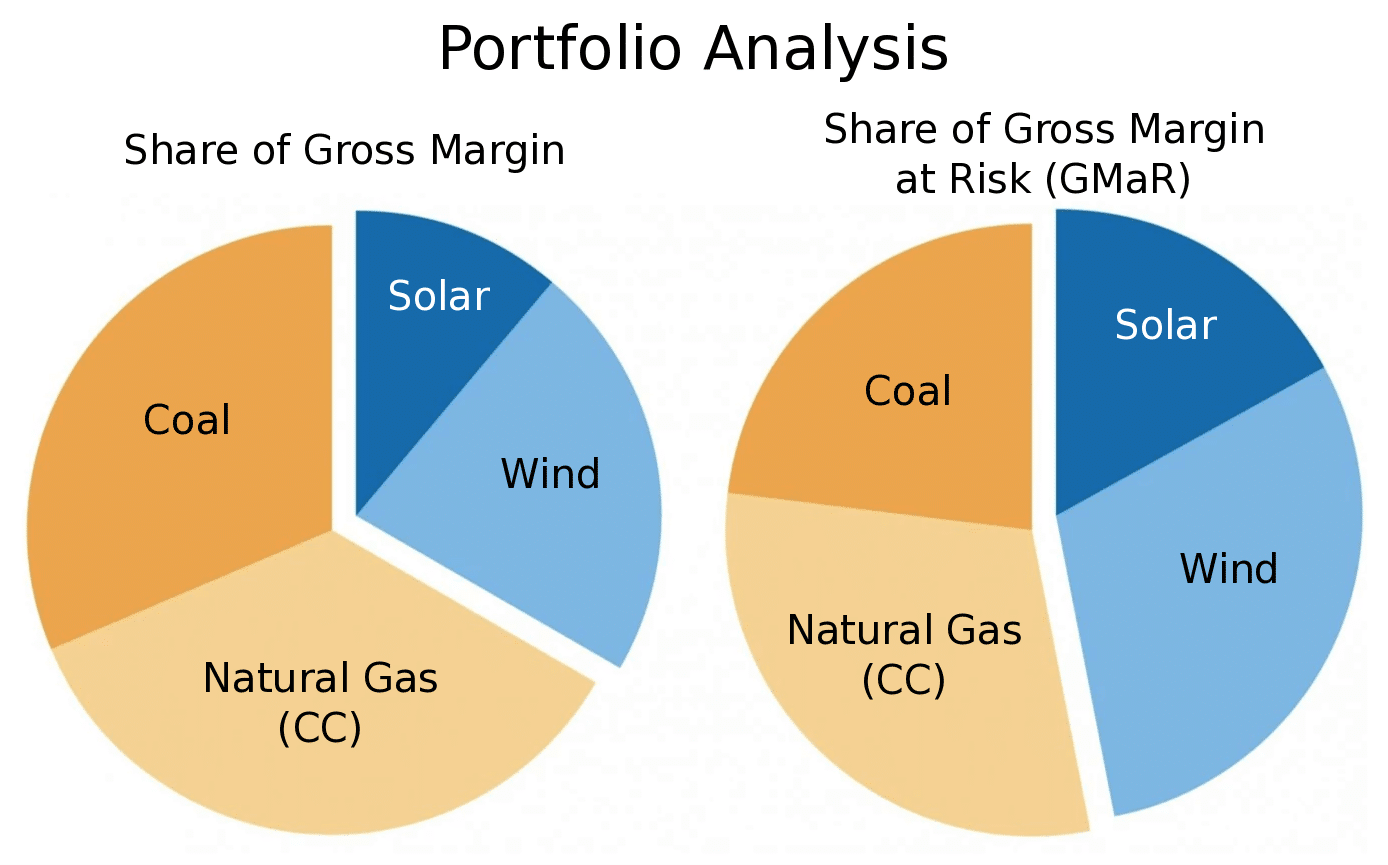

How much uncertainty is there around my future expected monthly cash flow, and what is my cash flow at risk/gross margin at risk (CFaR/GMaR)?

How sensitive are my portfolio’s future cash flows to changes in the expected price of power and/or fuel?

How do potential changes to my portfolio affect my expected cash flow and the uncertainty around it?

What are the best hedging options to reduce risk to my portfolio?

The Need for Analysis

Managing a portfolio of physical energy assets and financial contracts demands an integrated understanding of how day-to-day asset operations are coupled with uncertainty in financial markets for power and fuel. The particular characteristics of each asset and the terms of each contract dictate value, often in real time as generation and market prices fluctuate. The effect of each individual component on the value and risk of the broader portfolio can be complex.

For a well-diversified portfolio of financial contracts, losses for one contract are likely to be offset, at least in part, by gains in another. Correlations between the prices of various portfolio components are the primary drivers of this diversification effect. When physical energy assets with real-time value streams are included, quantifying the diversification effect of each requires more detailed analysis. One must consider the relationships between value and risk for each physical asset at the hourly or sub-hourly level.

These relationships are typically governed by highly locational time-dependent dynamics that couple the effects of weather, electricity demand, and market prices for fuel and power. For example, the same generation shape may have a completely different value and risk profile depending on the nature of the market price to which it is tied. Assessing the true value and risk of such a hybrid portfolio of physical assets and financial contracts requires a sophisticated simulation framework that can account for historically-observed trends in both generation and price.

The cQuant.io Solution

cQuant’s solution for energy portfolio cash flow reporting combines robust correlated Monte Carlo price simulation with optimal generation dispatch and cash flow analysis. Hourly simulations of electricity prices maintain historically-observed seasonal, weekly, and hourly trends in both price and volatility, as well as historical correlations between distinct price locations and with simulated fuel prices.

Optimal hourly asset dispatch leverages a full set of operational parameters, accounting for start costs, minimum up/down time constraints, partial load efficiency, and others user-specified plant characteristics.

With robust market price simulation, granular dispatch optimization, and insightful cash flow reporting, cQuant.io helps you paint a complete picture of future value and risk for your portfolio of physical and financial energy assets.

cQuant.io Users Can:

Report expected monthly generation, fuel burn, and gross margin, as well as uncertainty around the expected value.

Aggregate reporting variables across physical assets and financial contracts to report expected values and uncertainty by asset/contract, asset type, and portfolio.

Report monthly and annual cash flow and cash flow at risk (CFaR) at the portfolio-level and for individual assets.

Easily define scenarios on both future prices and physical/financial portfolio components to asses the effect on portfolio value and risk.

Quickly re-run previous analyses against updated forward market prices to generate “mark-to-market” reports and track value over time.

Assess the effectiveness and risk reduction value of prospective physical and financial hedges.