Corporate Renewable Energy/Storage Analysis

Business Questions

The Need for Analysis

Corporate sustainability has become virtually synonymous with renewable energy procurement in recent years. This has led numerous companies to enter into power purchase agreements (PPAs) in order to procure “green” energy credits they can use to offset their energy consumption. As a consequence, many companies whose primary corporate mission is not inherently energy-focused have developed direct exposure to the extreme volatility and unpredictability of wholesale electricity markets.

As corporate renewable energy portfolios grow, it becomes imperative to understand the associated financial risks and to monitor how these risks evolve as market conditions change. The needs of each portfolio are different, and there is no “one-size-fits-all” solution for risk mitigation. Detailed analytics can help highlight the benefits, costs, and financial risks of prospective renewable contracts a corporation is considering purchasing or already has on the books. It can also arm the purchasing entity with an independent assessment of contract value and risk, enabling more effective negotiations on contractual terms and overall price.

While direct renewable energy procurement through PPAs and other long-term structures will never be entirely risk free, careful analysis of how individual contracts contribute to value and risk at the portfolio level is a good first step toward an effective risk mitigation strategy. Selecting the right contracts with the right terms in the right locations and with the right risk profile can go a long way toward building an energy portfolio that’s sustainable for not only for the environment, but the balance sheet as well.

The cQuant.io Solution

cQuant’s solution for corporate renewable energy and storage analysis enables companies traditionally operating outside the energy sector to access the same analytical models used by renewable and storage project developers to structure and price PPAs. This multi-step analytical process includes a fundamentally-derived electricity price forecast at the hourly level through the project lifetime, robust Monte Carlo simulations of wholesale energy prices at multiple levels of granularity in space and time (forward, spot, and basis), and simulations of generation intermittency and its co-variation with prices. Battery storage assets can also be modeled alongside renewable assets, either in front of or behind the meter, and the entire portfolio of renewable energy contracts can be viewed holistically or sliced at any desired subportfolio level.

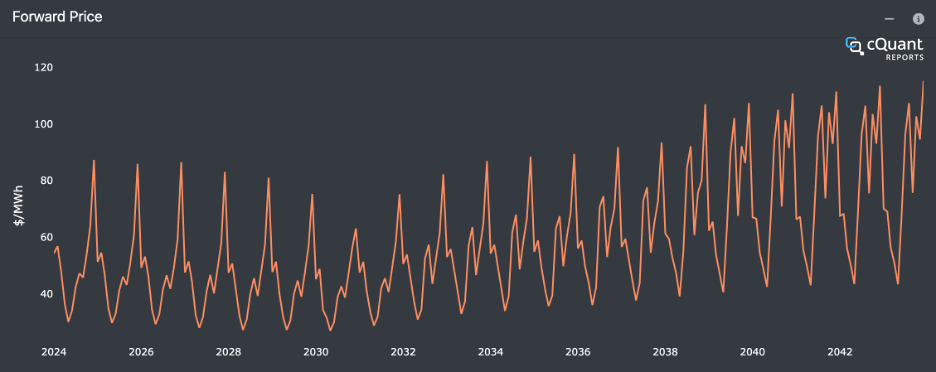

cQuant’s fundamental forward price forecast provides insight into the future evolution of hourly electricity prices in response to changing market fundamentals such as wholesale electricity demand, renewable energy adoption, generator additions and retirements, long-term gas prices, and other key drivers. Users can easily define scenarios on such these forward-looking fundamental assumptions, assessing the impact of different future scenarios on market price outcomes and the value of any corresponding PPAs. This allows the ability to define a “what if” scenario on future market conditions and nearly instantaneously assess the impact on the value of an individual contract or the portfolio as a while, eliminating the long wait times and high costs associated with consultant-driven re-analysis.

Figure 1. (Top Image) Monthly price forecast for NP15 Day-Ahead prices in California.

Figure 1. (Top Image) Monthly price forecast for NP15 Day-Ahead prices in California.

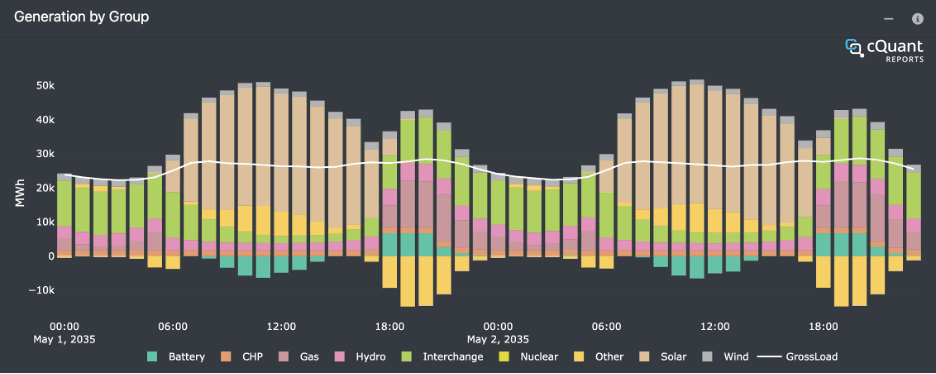

(Bottom Image) Forecasted hourly generation by type across the CAISO footprint in May 2035.

All cQuant simulation and valuation methodologies accurately reflect important real-time market dynamics including generation-price covariance (i.e., renewable penetration risk and price cannibalization), node-to-hub basis variation, hourly shaping of generation and price, and the extreme volatility that can characterize real-time market prices. This allows unparalleled valuation and risk assessment for specific PPA clauses such as price floors/ceilings/collars, revenue share agreements, hub settlements, volume firming agreements, proxy generation/revenue swaps, and many others. Because results can be viewed either contract-by-contract or in aggregate at the portfolio level, users can quickly compare and contrast different procurement scenarios to understand their net effects on the broader portfolio.

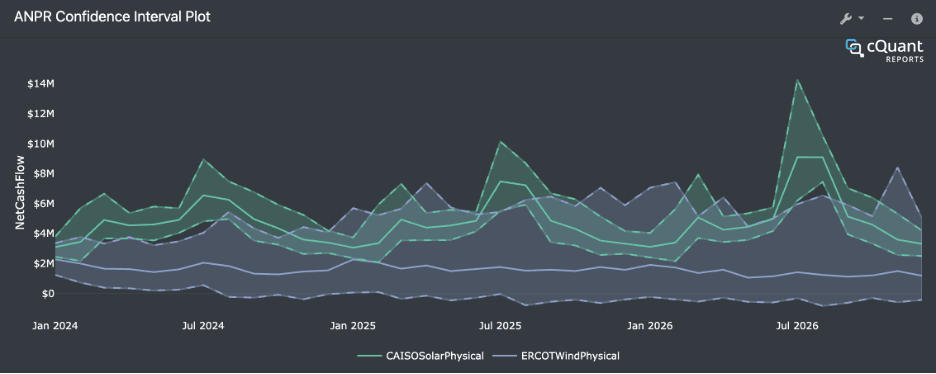

Figure 2. Forecasted monthly cash flow confidence bands for a solar project in California (green) and a wind project in Texas (blue).

Figure 2. Forecasted monthly cash flow confidence bands for a solar project in California (green) and a wind project in Texas (blue).

As benefits of this detailed and impartial analysis, cQuant users have cited enhanced negotiations with contracting counterparties and improved visibility into their portfolio’s value and risk within the wholesale electricity market. This has yielded increased confidence in financial forecasting and budgeting while supporting the continued pursuit of ultimate corporate sustainability: 100% renewable energy and beyond.