Bitcoin, Cryptocurrency, and High-Performance Computing

Business Questions

How does volatility in energy markets impact cryptocurrency mining and other high-performance computing applications?

How can I optimize cryptocurrency mining around energy prices to limit my exposure to price spikes?

How much value can I generate by leveraging the flexibility of high-performance computing to provide ancillary services to the grid?

What is my overall risk exposure from energy prices, and how would cryptocurrency mining mitigate or amplify risks from other portfolio assets?

How can I hedge my cryptocurrency mining revenue to protect against market price volatility?

The Need for Analysis

Data centers that focus on cryptocurrency mining, deep learning, computer vision, and other high-performance computing (HPC) applications require significant amounts of energy. Scaling up these applications allows them to interconnect to the grid and acquire electricity directly from wholesale energy markets. This can provide important financial advantages over paying standard utility rates, but also exposes these data centers to the volatility inherent in wholesale energy prices. Wholesale energy prices vary somewhat predictably throughout the day and throughout the year, but can also vary wildly in the near-term based on generation outages, extreme weather events, and other risk drivers. During these scarcity events, prices can reach 100x normal levels, exposing data center operators to enormous costs for running their machines.

Fortunately, cryptocurrency mining and other HPC applications frequently have the flexibility to thrive under these conditions. Cryptocurrency mining rigs and servers that can quickly ramp up and down can respond to short-term changes in energy prices more easily than either traditional generation assets or large commercial/industrial customers, allowing them to potentially pivot around price spikes and reduce cost. Furthermore, large mining rigs and servers can even be paid to provide ancillary services to the grid, increasing or decreasing power consumption at the direction of the independent system operator to help regulate voltage and frequency of power flowing on the grid or provide demand response during periods when load must be shed. Providing ancillary services to the grid allows these assets to create additional revenue, particularly in regions with inflexible supply and volatile demand.

The cQuant.io Solution

cQuant's cryptocurrency mining solution leverage Monte Carlo simulations of energy markets at the hourly level combined with dynamic optimization of data center operations to model the exposure of cryptocurrency mining to energy market price volatility and uncover the value of ancillary services revenue streams. These simulations ensure that cryptocurrency assets and data centers are evaluated against a coherent and consistent set of futures in order to give a true portfolio-level view of performance and risk.

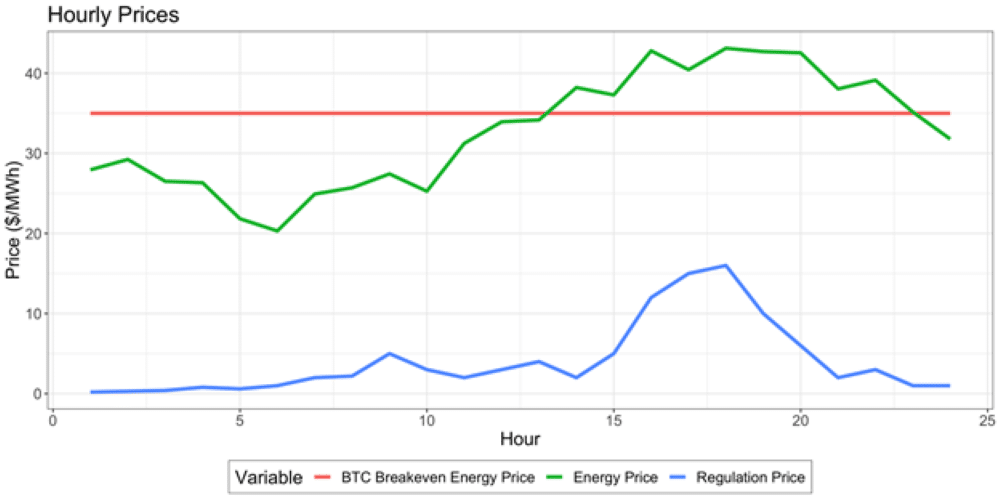

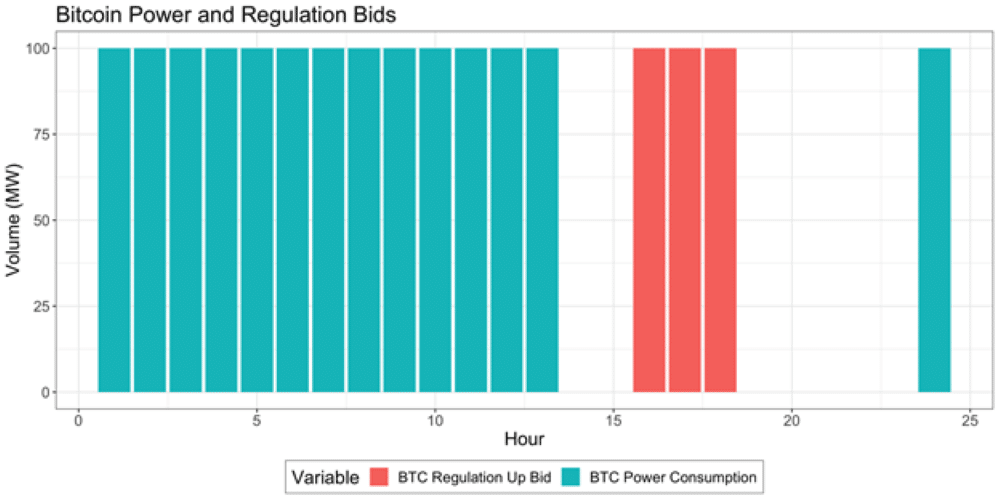

The images above illustrate how cQuant’s approach optimizes bitcoin mining operations in response to simulated market prices. The top figure overlays simulated prices for energy and regulation with the breakeven energy price for mining bitcoin, calculated based on bitcoin market prices and mining parameters, including energy consumption, hash rate, and difficulty. Power prices in the first half of the day are less than the breakeven energy price, so the model mines bitcoin during these hours. Energy prices in the afternoon exceed the breakeven energy price, so the asset generates revenue by providing regulation during hours in which regulation prices spike. cQuant’s solution optimizes these revenue streams simultaneously to provide robust estimates of asset value and risk, tailored to the specific characteristics of markets in which assets operate.

cQuant.io Users Can:

Value cryptocurrency and high-performance computing assets based on hourly power price simulations and co-optimized operation to expected mining revenue, energy costs, and ancillary services revenues.

Compare the performance and valuation of assets across various geographic regions and grid locations, down to the nodal level.

Report expected performance and risk at the individual asset, subportfolio, or overall portfolio level and efficiently track these metrics over time.

Design and test risk-mitigation options to limit downside exposure to unexpected market conditions.