Assessing the Value and Risk of Multiple PPA Structures

Business Questions

I have several Power Purchase Agreement (PPA) offers, each with different prices, contractual terms, technologies, and geographic locations...

Which offer provides the best value?

Which offer most reduces our total energy portfolio risk?

Which offer, when added to our current portfolio, achieves our company’s sustainability goals?

How can I easily track the mark-to-market (MtM) value of my PPAs over time as market conditions evolve?

The Need for Analysis

The landscape for renewable procurement is becoming increasingly competitive & overwhelming. With Environmental, Social and Governance (ESG) on the forefront of every Chief Financial Officer’s mind, transitioning to carbon free, or even carbon negative, is critical. This new paradigm delivers a complex set of decisions, opportunities and risk.

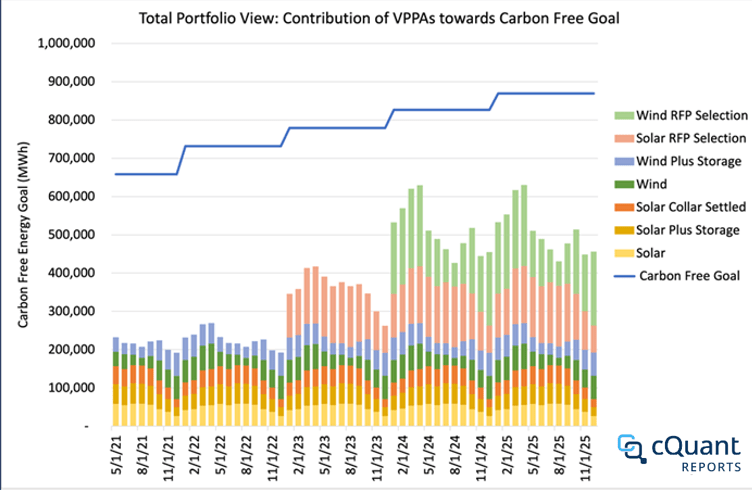

During the clean energy procurement process, corporate buyers are tasked with evaluating dozens or even hundreds of RFP responses. These responses include PPA contracts with varying terms, geographies, energy shapes, storage options, etc. If their value and risk are not properly understood from the date of signing through the life of the contract, PPA/VPPAs can result in significant negative cash flow for the company (Figure 1).

Figure 1. Holistic view of a company’s growing energy portfolio against their carbon reduction goal over time.

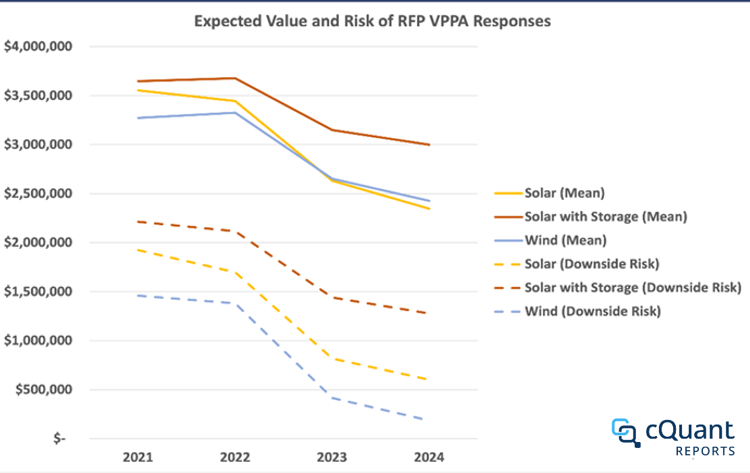

The value and risk of a PPA is derived from two main sources: contractual terms and geographic realities. To properly value a PPA, it is important to accurately model terms such as the contracted price, price settlement floors or ceilings, and price escalation clauses. In addition, a PPA’s value and risk is very sensitive to the geographic realities of the underlying renewable asset. Geographic drivers of risk include basis risk between the node and hub settled price, the intermittency of generation, and the covariance between renewable generation and market price. As renewable energy increases across the grid, it is important to understand the covariance risk attached to any new renewable VPPA (Figure 2).

Figure 2. The expected value and downside risk (P5) of three VPPA structures: solar, wind, and solar + storage.

The cQuant.io Solution

cQuant.io enables renewable buyers that operate outside of the traditional energy sector to use the same analytic tools being used by large energy companies. cQuant enables your team to manage the existing energy portfolio, evaluate new VPPA/PPAs and the financial risks associated with these energy contracts. cQuant's analytical process includes Monte Carlo simulations of market prices (forward, spot, basis and ancillary services), simulation of resource intermittency for both wind and solar assets, and an overall quantification of their combined effect on contract value. Additionally, battery storage assets can be modeled alongside renewable assets, and the entire portfolio of renewable energy contracts can be viewed holistically or sliced at any desired user-defined aggregation level.

Our cloud-native tools are developed and supported by a large team of quantitative analysts, energy experts and model developers. As results of this detailed and impartial analytics, cQuant users have noted improved negotiations with contracting counterparties as well as visibility into their portfolio’s value and risk within the wholesale electricity market.

cQuant.io Users Can:

Model all types of PPA contract structures, generation variability, co-sited battery storage assets, and dynamics of geographic location.

Determine the value and risk of PPA options based on hundreds of simulations of intermittent generation and market prices.

Conduct a component Gross Margin at Risk (GMaR) analysis to quantify the risk reduction value of RFP responses when added to the broader energy portfolio.

Develop automated processes to quickly determine the most beneficial RFP response in terms of value, risk, and contribution to our company’s sustainability goals.

Access actionable, customized reports for quick, executive-level decision making.