Mark-to-Market (MtM) Reporting

Business Questions

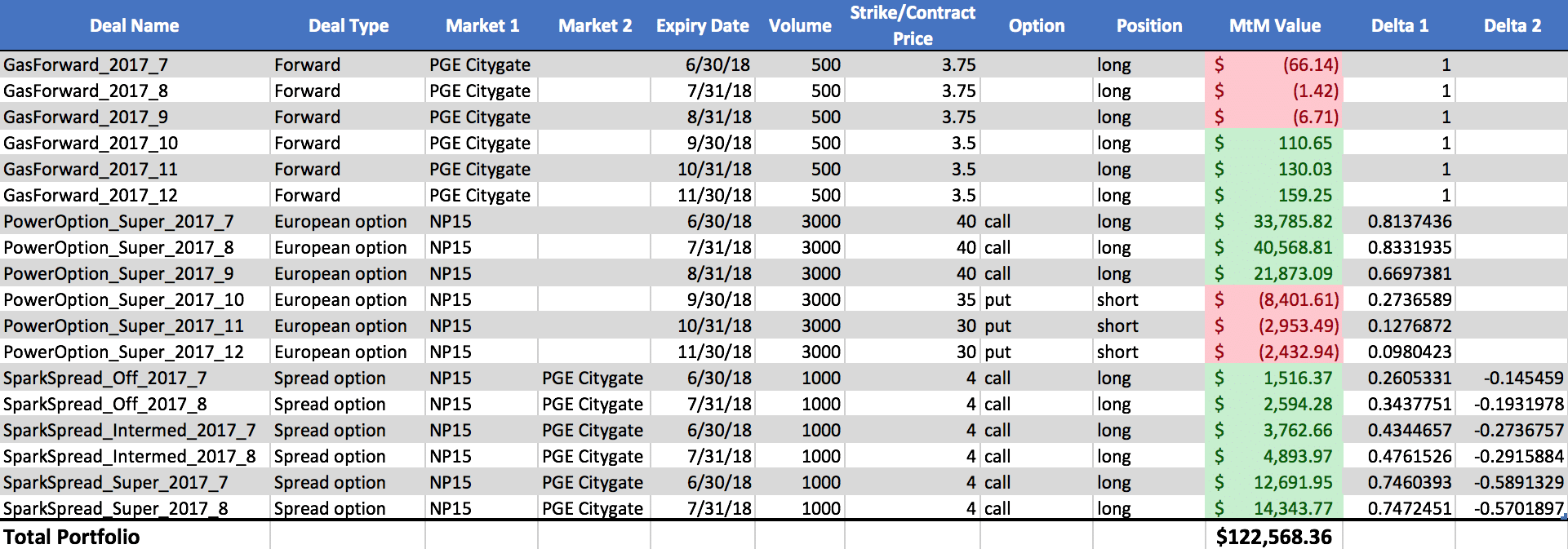

What is the current MtM value of my portfolio of physical and financial assets?

How can I understand current value and track value over time for physical assets such as thermal power plants or renewable generation facilities?

How can I get an early warning sign to identify market price anomalies that pose significant changes in value to my particular portfolio?

How can I efficiently generate a periodic MtM report to satisfy my accounting requirements?

What is the value of my nonlinear financial contracts (e.g., options, two-legged deals, etc.) prior to expiry?

The Need for Analysis

Asset value can change quickly for participants in today’s highly uncertain financial energy markets. Whether a physical generating asset or a financial contract, tracking MtM value over time is an important first step in understanding the upside and downside risk associated with asset ownership. Moreover, for a portfolio involving numerous commodities, price locations, and counterparties, it is important to keep track of how each component enhances or detracts from portfolio value as a whole.

While MtM accounting is a requirement for many energy market participants, it’s also an important risk management tool. Rapidly changing market prices necessitate a flexible framework for understanding current portfolio value and for drilling down to identify key value drivers and cost centers. Periodic MtM reporting can provide an early warning sign when price moves begin to adversely affect portfolio value. It can also identify volatile portfolio elements as targets for future hedges or other risk reduction measures.

The cQuant.io Solution

cQuant.io has a suite of analytical solutions to satisfy MtM reporting requirements and simultaneously add value and data-driven insights to the process. Comprehensive tracking of MtM value at the asset and portfolio level leverages industry-standard valuation formulas for financial contracts and robust stochastic asset valuation analysis for physical assets.

cQuant.io’s MtM reporting solution allows you to leverage your reporting requirements into actionable business intelligence, allowing you to understand your portfolio’s key value drivers, target volatile or costly components, and mitigate risk.

cQuant.io Users Can:

Report MtM value at the portfolio level and drill down by asset (physical or financial), asset/deal type, counterparty, trader, commodity, and delivery period.

Easily re-run past analyses using updated forward contract prices.

Perform scenario analysis on trade volumes and market prices to identify key portfolio value drivers and conduct stress tests.

Feed results directly into comprehensive value at risk (VaR) and cash flow/gross margin at risk (CFaR/GMaR) reporting tools for more detailed risk assessment.