Beyond Pay-As-Produced: The Rise of Hybrid and Shaped PPAs

Power purchase agreements (PPAs) have long served as a critical mechanism for financing renewable energy projects. Historically, these contracts typically used “pay-as-produced” settlement terms to dictate the volume of energy covered under the contract. This meant the buyer paid a fixed price for the energy produced by a given renewable generation resource, contingent on its intermittent production. In exchange, the buyer received the market price at the settlement location as well as any renewable attributes (e.g., guarantees of origin or renewable energy certificates). While these contracts helped accelerate the buildout of wind and solar assets by providing long-term securitized cash flows for the asset developer, they also concentrated most of the market price risk on the buyer. High market prices were good for the buyer, but low prices could result in large payments at monthly settlement.

As the European electricity market has transformed in recent years with significant deployment of solar and wind generation, market prices have become increasingly depressed during the very hours in which this intermittent generation is present. This phenomenon has led to a significant erosion of renewable capture prices—the average price received by renewable generators for their output—and has diminished the value of traditional pay-as-produced PPAs for buyers. Today, many buyers find themselves exposed to “wrong-way” risk, or covariance risk, under these contracts: being subjected to low market prices during periods when generation volumes are high while being unable to capitalize on high prices due to low renewable production volumes.

This misalignment in hourly generation and market prices has made pay-as-produced PPAs significantly less attractive to buyers and prompted the market to respond with new and creative structures. Two such contractual structures are hybrid and shaped PPAs—products that introduce dispatchable energy storage components and volumetric guarantees to mitigate the capture price erosion experienced under pay-as-produced contracts and better align renewable volumes with offtakers’ native demand profiles.

Under a hybrid PPA, the storage can charge from renewable production during periods when market prices are depressed, waiting to dispatch this energy until later in the day when prices rise due to elevated evening demand and reduced solar generation. While this natural “reshaping” of the renewable generation can significantly improve economics for the buyer by avoiding the covariance risk noted above, shaped PPAs take this a step further still by guaranteeing volumes at an hourly level under the contract. They use a combination of the renewable resource, energy storage, and direct spot market purchases to provide the required energy volumes under the guarantee. Because both hybrid and shaped PPAs combine intermittent generation with energy storage operation, they are more complex to value than traditional pay-as-produced structures; however, they do promise to better align the interests of buyers and sellers amid a rapidly shifting energy landscape.

From Passive to Dynamic PPA Structures

The traditional pay-as-produced PPA worked well in an era of relatively flat and predictable hourly price shaping and modest renewable penetration. However, today’s hourly price patterns are anything but flat, with grid-wide renewable generation playing a significant role in price formation. As an example, solar generation is typically abundant during midday hours, resulting in a supply glut that drives prices downward, potentially even into negative territory. Then, as the sun sets and electricity demand begins to rise into the evening, prices trend higher to incentivize traditional forms of dispatchable generation to come online and meet demand. Under these conditions, fixed-price pay-as-produced contracts no longer offer the value they once did. What’s more, the anti-correlation between generation and prices makes them poor financial hedges against a native demand position since generation volumes tend to be lowest during precisely the hours when demand is most expensive to serve.

To address these shortcomings, the market is embracing hybrid and shaped PPAs that integrate renewable generation with battery energy storage systems (BESS) under a single contract, potentially even incorporating an hourly volumetric delivery guarantee. These structures enable sellers to shift energy from low-value to high-value hours—charging the battery when renewable generation is abundant and prices are low and then discharging it during higher-priced periods. This provides some flexibility in the timing of the renewable energy and the volumetric guarantee serves to mitigate both volumetric and covariance risk for the buyer.

The result is generally mitigated risk for the offtaker compared with a pay-as-produced PPA. The seller does bear considerably more risk under hybrid PPAs, particularly with shaped contracts, but sellers are often also better equipped to manage this risk than buyers. Energy traders, developers, and independent power producers often have access to diverse portfolios and teams that actively manage and hedge their positions. With the right analytical tools in place, they can effectively optimize the battery’s dispatch and procure shortfalls in the market more cost-effectively than corporate offtakers or other buyers whose primary business may not be focused on wholesale energy markets.

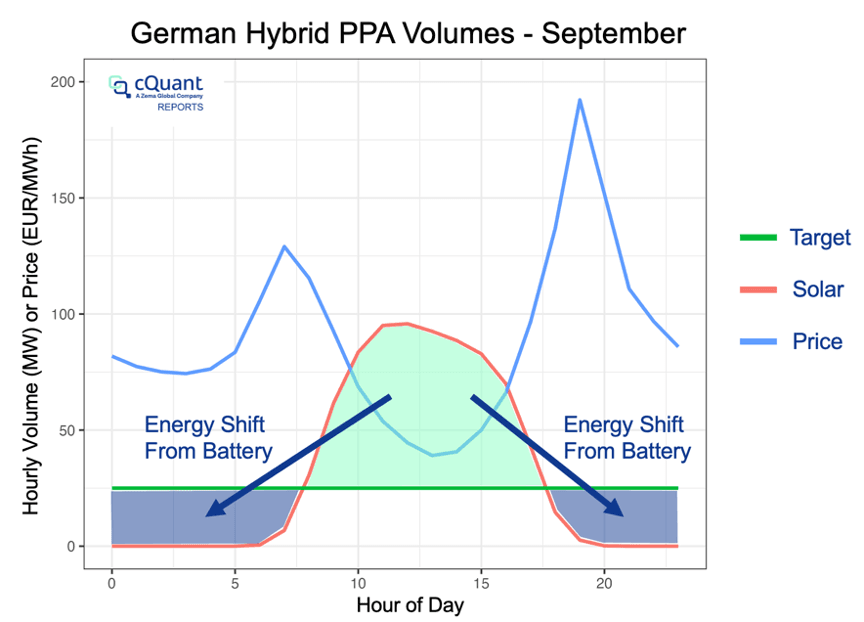

Figure 1. The solar generation resource overproduces relative to the target volume profile under a German baseload shaped PPA. To avoid loss of value due to depressed midday power prices, the battery can shift energy to satisfy the volume target during periods when prices are elevated and the solar resource alone falls short.

One example of a shaped PPA is shown in Figure 1, where a battery absorbs solar overgeneration during hours when the volume guarantee would otherwise be exceeded and then discharges the energy later during periods of shortfall. This not only helps satisfy the PPA’s volume target with physical resources under the contract but also avoids loss of value for energy that would otherwise be sent to the grid during periods when prices are depressed. As a result, the battery can considerably improve economics for the offtaker under the deal while also mitigating some of the seller’s financial risk associated with the hourly volumetric guarantee.

From the above example, the theoretical value of hybrid and shaped PPAs may be intuitively clear, but quantifying their impacts for buyers and sellers can be challenging. Below are some questions that should be considered:

- How much additional value does the battery provide?

- How large should the battery and renewable components be relative to a proposed volumetric shape guarantee?

- How often will the guaranteed volumetric shape be met by the physical resources?

The answers to these questions depend on the nature of the renewable resource (location, resource availability, project configuration, etc.), the market price dynamics at both the PPA and physical asset settlement locations (which may be different), and the capabilities of the BESS, among other factors. They also require rigorous analytics to uncover the proper project configurations and to quantify the premium the buyer should be willing to pay or the seller should aim to charge for the additional structure relative to a pay-as-produced contract.

Below, we show how cQuant’s industry-leading energy analytics can help answer these important questions for both buyers and sellers of hybrid renewable PPAs through analysis of an example 25 MW baseload PPA in Germany. In this contract, the seller guarantees baseload delivery (i.e., the same 25 MW output in all hours of the day), supported by a 193 MW solar plant and a 4-hour BESS capable of shifting generation. The solar plant is sized so that the annual expected generation is equal to the volume delivered under the baseload PPA, accounting for the plant’s roughly 13% around-the-clock capacity factor. The seller uses a combination solar generation, battery dispatch optimization, and spot market purchases to meet the delivery profile.

Assessing Battery Value and Size

As seen above, the anti-correlation between renewable generation and power prices can destroy value for a renewable resource or pay-as-produced PPA. To combat this loss of value, a battery can be used to shift energy from low-value periods to high-value periods, increasing the effective captured price of the combined project. To assess the added value the battery provides to the shaped PPA, we can look at the average price of energy “sold” to the market when production exceeds the target volume, and the average price of energy “bought” from the market to shore up production shortfalls relative to the target[1].

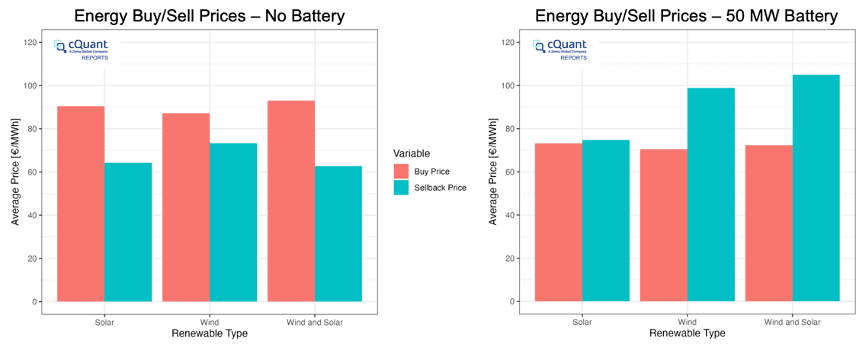

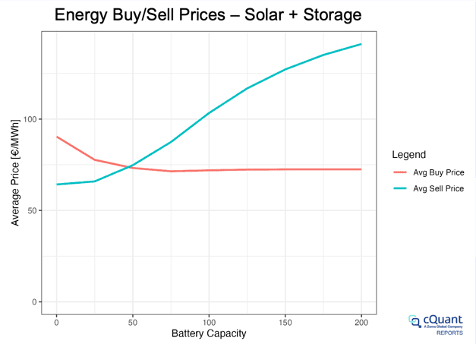

Without a battery, Figure 2 shows that we may lose as much as 30 EUR for each MWh that exceeds the target volume, selling at a low price and buying back at a much higher price during the evening peak. The battery flips this dynamic, resulting in a sell-back price that is consistently higher than the price to procure energy for the hours in which shortfall occurs. Figure 3 shows how these average buy and sell prices vary with battery size, providing a mechanism to optimize battery sizing relative to the additional value generated by the BESS and whatever installed cost would be realized. An interesting result is that, while the average sell price continues to rise as the battery becomes larger, the average buy price stabilizes significantly by the time the battery reaches just 50 MW in charge/discharge capacity.

[1] Most baseload PPAs are virtual contracts, meaning physical energy is not truly being sold back to the grid in cases where solar production exceeds the target volume. Instead, the contract settles financially against the net operation of the renewable and battery resources. Even though physical energy is not generally being “bought” or “sold” under a shaped PPA, the financials are equivalent and we use this terminology as a helpful heuristic to understand the settlement dynamics at play.

Figure 2. Average buy and sell prices of energy under a 25 MW shaped PPA in Germany with no battery (left) and with a 50 MW battery (right). Without a battery, over-generation relative to the target volume is sold at a significantly lower price than the energy bought back to satisfy volumetric shortfalls. As seen in the left image above, the buy price can average more than 30 EUR higher than the sell price, depending on resource type. The addition of a 50 MW battery changes this outcome, causing average sell prices to significantly exceed buy prices. The type of renewable resource (solar, wind, or solar & wind) plays a key role in determining how much added value can be derived by the battery under the contract.

Figure 3. The average buy and sell prices for mis-matched energy under the 25 MW German baseload PPA vary with battery size. Larger batteries result in a steadily increasing average sell price, while the price for buying energy stabilizes around 74 EUR/MWh.

Target Shape Matching

In addition to assessing the added value the battery brings to the shaped PPA, we can also quantify its effect on matching the target hourly volumetric shape with the physical resources. A growing trend, particularly with large corporate offtakers, is to try and match some target volumetric shape with renewable resources in as many hours as possible. Relying on the market to purchase energy during periods where the supply portfolio falls short of the target means the energy procured may not be as “green” as desired. Batteries can help to increase the percentage of the guaranteed hourly shape that is met by the resources under the contract, maximizing the alignment between hourly renewable energy resources and the target profile.

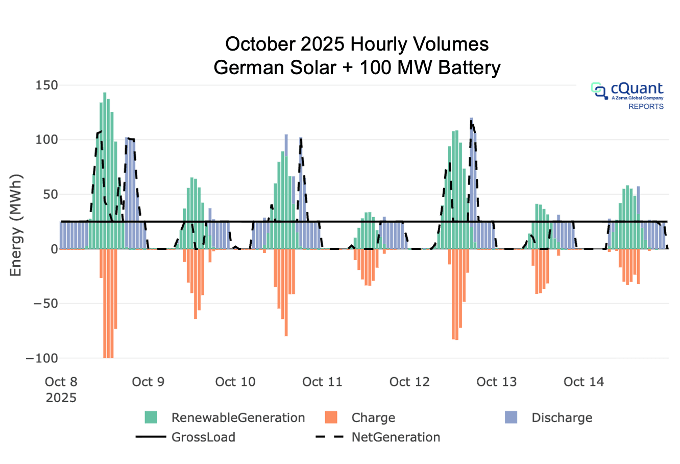

Figure 4 shows an example of hourly volumes under the 25 MW baseload PPA with a 100 MW 4-hour battery included. The battery tends to soak up excess solar generation relative to the target shape and then dispatch that energy to match the target volume during periods when prices are higher. In some cases, large price spikes provide enough economic incentive that the battery will discharge even though the target volumes are already met, capture the market price and adding additional value under the contract. There is an important trade-off to acknowledge between matching a target volumetric profile land maximizing the value of the battery. That is, prioritizing volumetric matching over pure profit maximization will always come at a cost. The size of this cost depends on the nature of the market price dynamics relative to both the target volumetric shape and the intermittent renewable generation.

Figure 4. One week of hourly volumes under a 25 MW baseload shaped PPA in Germany. Here we have a 100 MW 4-hour battery that aims to charge during periods where the solar over-generates relative to the target hourly volume, and to discharge to meet the target volume during the hours in which price is highest. Because some hours may have very high market prices, there are times when the battery elects to discharge even though the volumetric target has already been met to capture value from the market. Generally, we see much better volumetric alignment with the battery than we would with solar alone.

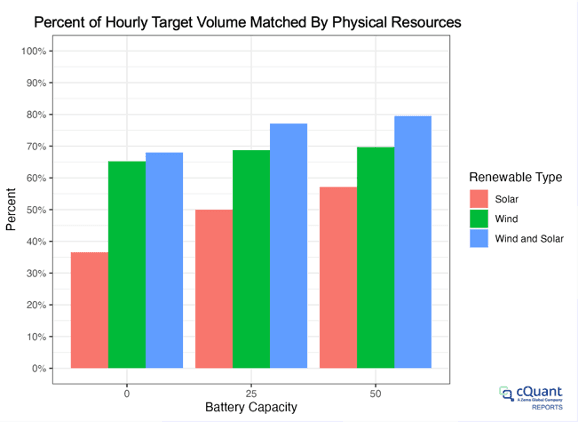

Generally, as we add more battery storage, the percentage of the target hourly volume we can match with the resources under the PPA grows. However, the battery is not the only factor in how much of the target can be matched; the nature of the renewable generation is critically important as well. Figure 5 shows the percentage of the hourly target volumes matched by wind, solar, and a combination of wind and solar. Because of the strong misalignment of hourly volumetric shapes between the solar generator and the hourly volume guarantee, the percentage of match is lower for solar than for wind or the combined wind and solar resource. Even the presence of a battery only marginally improves the volumetric match. This is generally expected: we need a lot of storage to “fill in the gaps” between the solar generation shape and the flat baseload shape that is the contract’s target.

Figure 5. The percentage of hourly volume matched by the physical resources (that is, exclusive of market purchases) grows considerably with battery storage capacity. Note that the nature of the renewable resource(s) also plays a critical role, with a combination of wind and solar providing the greatest match of the baseload volumetric shape both with and without the inclusion of a battery.

The wind and wind+solar resources start out with roughly the same percentage match in the absence of any battery, but the addition of a BESS is much more impactful for the wind+solar resource. This is because the combination of wind and solar produces more hours than wind alone where there is overgeneration relative to the target volume. This allows the battery to charge from the excess and shift the energy to later periods where shortfalls exist between the native generation and the target shape. That is, in the presence of a battery, the renewable shape should be strategically composed to provide enough over-generation that the battery can be sufficiently utilized for volumetric shaping purposes.

The Role of Analytics in Hybrid and Shaped PPAs

As we’ve seen above, just as renewable PPA contract terms have evolved, so too must the analytics that support buyers and sellers of these new deals. The optimal design, pricing, and execution of hybrid and shaped PPAs requires robust modeling of:

- Renewable generation intermittency

- Market prices and covariant relationships with renewable generation

- Optimal battery operation

Tools like those offered by cQuant and Zema Global enable energy buyers, sellers, and traders to make informed decisions about contract structuring, asset sizing, and risk management. With customizable modeling environments, robust scenario analysis, and tight data integration, these platforms form the foundation of a decisioning infrastructure that is essential for market participants navigating the PPA landscape of tomorrow.

Conclusion

As renewable energy continues to be deployed at scale, furthering the energy transition and our reliance on intermittent renewable generation, the one-size-fits-all pay-as-produced PPA is rapidly becoming obsolete. Hybrid and shaped PPAs represent the next evolution in contracting—bringing the promise of reduced intermittency risk for buyers and higher overall contract value for sellers. However, these deals come with greater complexity and require more advanced valuation approaches and active management.

In this environment, flexibility is power—not just in the physical assets themselves, but in how they are modeled, contracted, and optimized. Armed with the right analytics, energy market participants can structure smarter contracts, mitigate risk, and capture value in an increasingly dynamic and shape-sensitive marketplace.

The Portfolio Precision journey doesn’t end here—but this marks a major step toward aligning operational flexibility with market opportunity.

*Ready to Bring Precision to Your Portfolio? Hybrid and shaped PPAs demand powerful analytics to unlock their full value. Partner with cQuant, A Zema Global Company to model, optimize, and manage your renewable energy strategy with confidence. Contact Us Today to learn how our solutions can help you achieve portfolio precision.