Monte Carlo Value-at-Risk (VaR)

Business Questions

What is the current mark-to-market value of my portfolio?

How can I periodically monitor and report my portfolio’s VaR to ensure it remains below the limit specified by my organization’s risk policy?

How can I perform scenario analysis and stress testing to assess the effect of possible forward market moves on my portfolio’s value and risk?

How do contracts in my portfolio change in value as the underlying commodity prices move, i.e., what are my contract Greeks?

What is the VaR of my portfolio of non-linear (Options) instruments, complex structured transactions, and/or physical assets?

The Need for Analysis

In today’s highly uncertain commodity price environment, portfolio managers need an efficient and accurate way to monitor the value and risk within their portfolios. Global pandemics, catastrophic supply chain disruption, geo-political conflict, and extreme weather events are just some of the drivers of rapid fluctuations in market prices that can present an existential threat to a portfolio of contracts and/or assets. Having clear visibility into changes in portfolio value and risk as these types of events unfold can be the difference between taking decisive action to cover exposed positions and being forced to permanently close shop.

While a classical parametric VaR approach can be appropriate for portfolios heavy in linear instruments, it falls significantly short in cases where the portfolio contains options, complex structured transactions (e.g., renewable PPAs, tolling agreements, full requirements load contracts, etc.) or physical assets. In these cases, the closed-form approximations of value required by a parametric VaR model can mis-state risk and leave the portfolio exposed.

A simulation-based approach that takes into account the important nuances of complex contracts and physical assets is required for a more accurate picture of VaR. Such an approach allows more accurate modeling of prices and is not bound by a priori assumptions about the nature of the distribution of price returns. Conversely, a parametric VaR model typically assumes price returns are normally distributed; an assumption that is typically not the case in energy and commodities prices. Additionally, a simulation-based approach allows each portfolio element to be re-valued for each simulation path, yielding a distribution of future value outcomes that truly reflects optionality, hourly shaping and volatility (e.g., in the case of renewable assets or contracts), contractual nonlinearities, and even physical asset operational characteristics (e.g., for batteries or thermal generators).

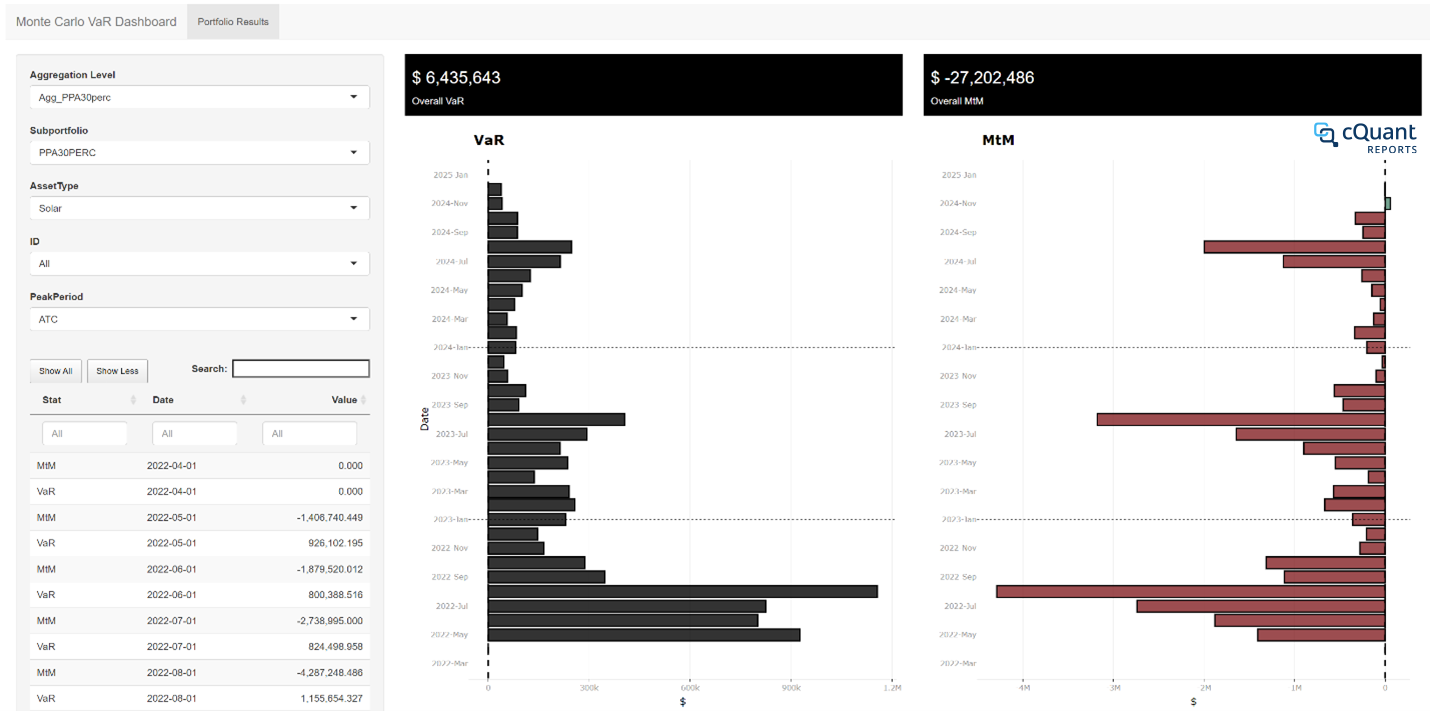

Figure 1: The above visualization shows the VaR and MtM of the portfolio slip by tenor or monthly exposures.

The cQuant.io Solution

Building on the risk factor simulations, valuations of all portfolio components leverage cQuant’s suite of best-in-class valuation and optimization models to accurately compute mark-to-market for everything from linear instruments and vanilla options contracts to bespoke structured transactions, complex renewable PPAs, full requirements load contracts, dispatchable thermal and battery storage assets, and many other types of positions. Implied volatility surfaces can also be directly supplied for use in option valuation, and users can tune volatilities and correlations for the purposes of stress testing and/or scenario analysis.

These purpose-built valuation models were designed to capture the important nonlinear effects that dictate value in today’s volatile and ever-changing market, giving the most accurate and robust view of portfolio value and risk possible. Users can also define hierarchical relationships within the portfolio to compute component and marginal VaR at various levels to aid in the explanation and interpretation of results. Finally, cQuant’s Monte Carlo VaR model integrates seamlessly with its Net Position at Risk (NPaR) framework, providing simultaneous and complementary views of portfolio risk ranging from short holding periods (VaR) all the way through delivery/settlement in the cash month (NPaR).

cQuant.io Users Can:

Report mark-to-market (MtM) and value at risk (VaR) for the total portfolio with drill-down capability from user-defined subportfolios and all the way to the individual trade/asset level.

Accurately capture value and risk for even the most complex contracts and physical assets.

Compute hierarchical component and marginal VaR at the total portfolio level or along any user-defined hierarchy.

Easily perform stress testing and scenario analysis to identify and mitigate outsized exposures.

Seamlessly integrate their view of VaR with longer-range flow metrics by integrating with cQuant’s Net Position at Risk (NPaR) workflow.