Cash Flow at Risk (CFaR) Reporting for Utilities

Business Questions

The Need for Analysis

Most utilities have invested in a trade capture (a.k.a. ETRM) system. But they are often disappointed by the risk and valuation analysis that those trade capture systems provide. Trade capture systems lack the purpose-built market simulation and asset optimization tools required to deliver accurate cash-flow and cash-flow-at-risk (CFaR) analysis. Without CFaR analysis, hedge optimization is nearly impossible.

cQuant's analytic platform provides a modern, efficient and industry acclaimed solution to value, analyze and risk manage your total energy portfolio. A complete quantitative modeling framework combined with modern cloud-native technology will empower your analysis team to deal with any analytic necessity and derive the desired insight to make effective decisions.

cQuant’s Cash Flow at Risk (CFaR) model brings the basis and tools needed to forge your view and advanced analysis of any energy or commodity portfolio:

- cQuant’s quantitative models automatically capture the statistical properties of combined time series (price, load, generation, basis, heat rate, and more) to bring the best simulation framework to your team of quants.

This provides the foundation for accomplishing added value tasks including scenario and stress testing and credit risk management.

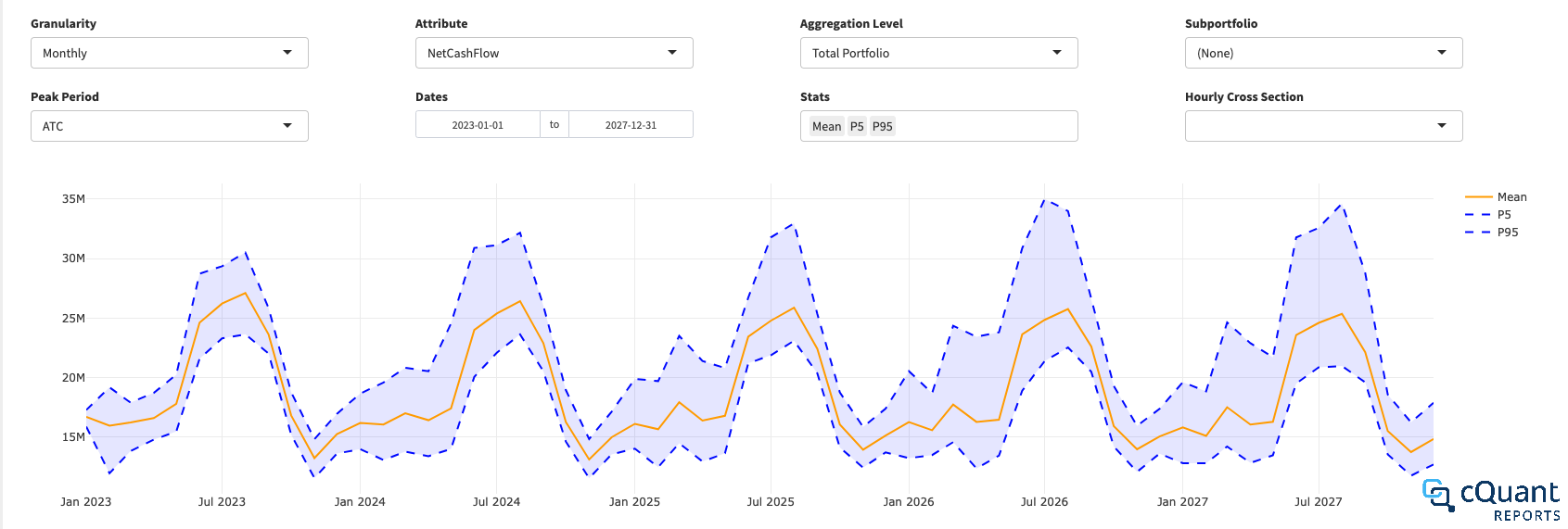

Figure 1: Cash Flow at Risk (CFaR) – Full portfolio 4-year horizon

The cQuant.io Solution

cQuant’s models deliver key business reports to support credit risk management:

A comprehensive set of dashboards for reporting:

- Calibrated outputs, validation data for the calibration and general model parameters that can be used as-is or overwritten based on needs.

- Dashboards for each individual asset type (wind, battery, solar, thermal, etc.).

- A holistic portfolio view with the ability to drill down by trader/region/asset/deal ID/and more.

State-of-the-art optimization routines for asset dispatch, from prompt month to 20+ years. Non-dispatchable renewable assets generate their own dispatch simulations, correlated to and impacting market prices.

Collaborative workspaces to share swift analysis across pre-trade analysis team, investment team, front office, credit risk, and risk management teams.

Cloud-native solution with zero IT maintenance (key in hand/turnkey solution):

- Infrastructure, operating system, software maintenance, and user support are all included in the subscription.

- Automatic platform updates as a staged process through pre-production environments.

- Fully features API for platform integration within clients IT landscape and ability to program automation, within day analysis and end of day computations.

cQuant.io Users Can:

Hedge, manage, and optimize their entire portfolio.

Value, stress-test, and analyze individual assets.

Incorporate any other portfolio item into cQuant’s engine (ex. vanilla options, exotic options, ad-hoc payoff contracts, etc.).

Analyze market effects on Cash Flow at Risk (CFaR).

Understand the source of risk by any customized sub-portfolio attributes.