Renewables Have Killed Baseload…Now What?

***This article is the second in a two-part series on the effects of high renewable penetration on thermal generation operational paradigms. The first article discussed how intermittent renewable generation has transformed the grid to the point where many combined cycle plants are unable to operate profitably.***

So baseload power is on its way out and intermittent renewable generation is on its way in. There’s been a lot of buzz about how this represents a “tremendous transformation” or a “historic transition“, and the trend has even received attention in the national political arena with the controversial Grid Resiliency Pricing Rule proposal of late 2017, since defeated by the Federal Energy Regulatory Commission. Suffice it to say there’s been a lot of rhetoric around the declining relevance of baseload electricity supply. However, there has been little practical insight or guidance offered to organizations with a stake in the energy game—precisely those that will be most affected by the transformation. For example:

- What does the end of the baseload supply paradigm mean for energy companies and purchasers of long-term renewable PPAs?

- How can companies participate in the renewable energy revolution without being destroyed by it?

- And what role should data analytics and energy risk management play throughout the impending transition.

In this article, we offer some practical perspectives on these questions and discuss what the death of baseload power really means both today and in the near future. For more on how and why baseload is becoming increasingly irrelevant, be sure to check out the first article in this two-part series.

Long-standing structural energy market dynamics will be challenged

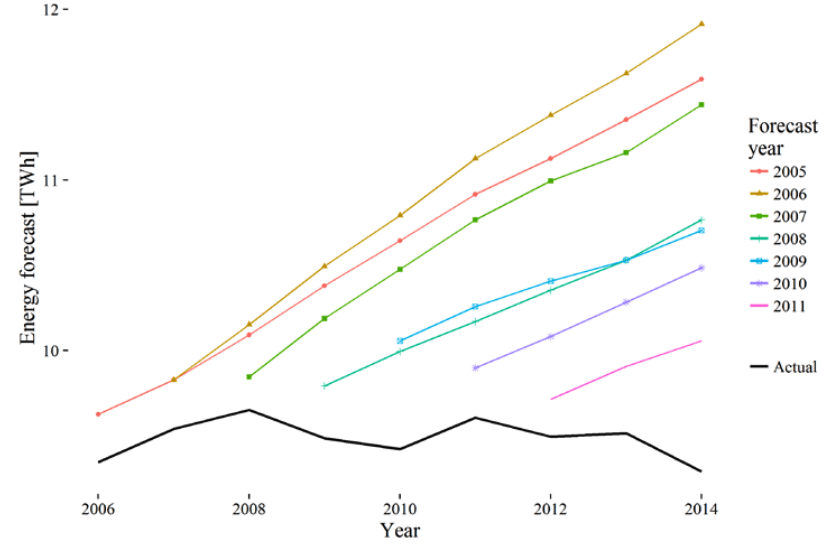

You can’t talk about the future of electricity supply without addressing the future of electricity demand, and we’ve observed an important trend over the better part of the past decade that is becoming harder and harder to dispute: demand growth has stagnated. Continued growth in electricity demand is a long-standing assumption that has been baked into electric utility supply planning and budget forecasting for decades. A late 2016 report by Lawrence Berkeley National Laboratory includes a striking figure that illustrates just how resistant supply planners are to giving up the load growth assumption (see Figure 1 below). Challenging this assumption will provide an important perspective that can ultimately inform an outlook on future wholesale electricity prices.

Figure 1. Comparison of forecasted and actual customer demand for a utility in the western U.S. Image credit: LBNL Report.

When stagnant electricity demand is viewed in the context of the evolving electricity supply stack that is undergoing rapid expansion of renewable generation capacity and significant retirement of fossil-fueled generation, additional long-held market assumptions come into question. One of these is the assumption that natural gas and electricity prices will tend to move in the same direction at the same time. The ratio of the electricity price in $/MWh to the natural gas price in $/MMBtu is referred to as the “implied market heat rate”. Measured in MMBtu per MWh, the market heat represents a measure of generation efficiency akin to a miles-per-gallon rating for a car. As market prices fluctuate, the real-time market heat rate loosely reflects the efficiency of the generator called on to provide the “next megawatt”, or the marginal unit of power to satisfy electricity demand. Since this marginal unit often runs on natural gas, the price of natural gas determines the cost of production, and correspondingly influences the marginal price of electricity.

However, as the electricity supply stack evolves, there is increasing likelihood that the marginal power needed to satisfy demand could be provided by a generation unit that does not run on natural gas, e.g., by renewables, batteries, or hydroelectric generation. In this case, the price of natural gas may have little to do with the marginal cost of power, causing electricity and natural gas prices to decouple. While it’s not likely the decoupling effect will persist across all hours of the day anytime soon, even its occurrence across a few hours when renewable generation is peaking could produce significant financial consequences for organizations with natural gas or power positions on the books. This includes power producers, load serving entities, and counter-parties to physical or financial power purchase agreements (PPAs). Such a break-down of market heat rates would directly contradict fundamental assumptions that underpin many long-term energy procurement and physical/financial hedging strategies. As such, these strategies should be reevaluated within the context of a market where baseload generation has become obsolete.

Wholesale electricity market prices over the coming decades are extremely uncertain

Demand stagnation and decoupling of market heat rates are virtually unprecedented dynamics in wholesale energy markets, and the market’s response as these trends become more pronounced is anyone’s guess. In particular, long-held assumptions that electricity prices will continue to rise into the future should be viewed as highly suspect. In fact, it is possible that wholesale electricity prices could actually fall in the coming years. The combination of demand stagnation, added renewable generation with little to no production cost, and continued retirement of outdated and inefficient fossil generation implies that the average cost of generating electricity will likely decrease.

As the grid evolves in response to the changing supply paradigm, new transmission and distribution costs, or other costs associated with managing grid reliability, may partially offset declines in the cost of electricity itself. However, long-term agreements that reference wholesale electricity prices may not capture these added grid-based costs, resulting in significant downside risk to counterparties. For example, many corporations today are signing long-term renewable PPAs that are financially settled against wholesale electricity prices at a particular grid location. In a scenario of falling electricity prices, these PPA buyers could see themselves making significant monthly payments for the losses incurred on their contracts. As a result, any purchase decisions that hinge on a long-term forecast of electricity prices should incorporate analysis that challenges the conventional notion that these prices will increase over time.

Generation flexibility will be highly valuable

Because renewable generation facilities can exhibit dramatic fluctuations in production output on short timescales, there will be a serious need for dispatchable generation that is responsive enough to make up the difference. These generation facilities must be able to ramp up and down quickly and to cycle on and off frequently in response to highly variable renewable production output. Such desirable operational traits have become synonymous with the term “generation flexibility”, and they will by highly valued in an era without traditional baseload generation. The increased emphasis on flexibility means that generators with high fixed startup costs incurred each time the unit turns on will be at a disadvantage. Additionally, generators whose efficiency significantly degrades as they ramp down will have a difficult time remaining profitable. Essentially, the same dynamic that is hurting baseload units today will be taken to its logical conclusion, and will eventually elbow out all but the most responsive technologies for delivering power to the grid.

The elephant in the room here is–you guessed it–batteries, or more broadly, energy storage. Batteries, flywheels, and other forms of energy storage can be extremely responsive, providing almost instantaneous power when needed. However, there is an important interplay between a storage technology’s ability to provide power and its ability to provide energy. For example, a battery may be able to provide a large amount of power to fill a short-lived gap in renewable energy generation caused by a large cloud passing over a solar facility or a momentary lapse in wind. However, using batteries to supply the total energy needed to fill a gap in solar production from an entire day of rain showers or snowfall is much more difficult. Batteries and other storage technologies have come a long way in recent years, but their ability to provide sustained power output over long periods of time still has a long way to go before they represent viable solutions for completely replacing flexible fossil generation. At least for the foreseeable future, there will be a significant need for highly-flexible fossil-fueled generation to ensure electricity demand in a baseload-free era is always met with adequate supply.

Data-driven energy risk management will be more critical than ever before

The impending fundamental shifts in electricity supply and demand and the corresponding impacts on market prices all mean that uncertainty and risk will permeate every aspect of the energy sector, from physical operation management to financial decision making. An intimate relationship with risk is nothing new for participants in electricity markets where wholesale prices that normally hover around $30/MWh can spike as high as $9000/MWh in the blink of an eye. However, in response to aggressive corporate sustainability targets and pressure to display environmental stewardship, there has been a growing trend of new businesses directly procuring long-term energy through PPAs. In many cases, the core business function of these companies is not directly tied to the energy markets, and they often do not have the in-house expertise to properly evaluate and continually monitor risk associated with their purchases. These organizations are particularly exposed to downside risk resulting from wrong-way market moves or breakdowns in long-standing structural market relationships. As more and more companies begin interacting directly with volatile energy markets, they will experience a growing need for sophisticated energy risk management and targeted hedging strategies that protect them from downside exposure.

Even for seasoned veterans of the energy industry, the fundamental shifts resulting from the end of baseload generation as we know it mean that many of the risk management strategies and assumptions they are familiar with will break down. Developing and testing new risk management strategies that leverage all data available will require access to sophisticated modeling capabilities and sound analytical methods. Models must be flexible enough to accommodate rapid scenario analysis custom-tailored to an organization’s particular portfolio. Just as flexible generation will be essential to reliable electricity supply, flexible analytics will be essential to maintaining long-term profitability and solvency throughout the energy transformation.

So renewables have killed baseload…now what? Now we adapt. At cQuant.io, we’re helping organizations adapt to the ever-changing energy landscape with our industry-leading cloud-based energy analytics platform. From renewable PPA valuation, risk assessment, and ongoing value monitoring to thermal asset valuation, cash flow reporting, and hedge analysis, we provide access to the advanced analytics your organization needs in an era without baseload generation.

Need a solution for your energy analytics? We can help!

Request your free demo today.