Value-at-Risk (VaR) Reporting

Business Questions

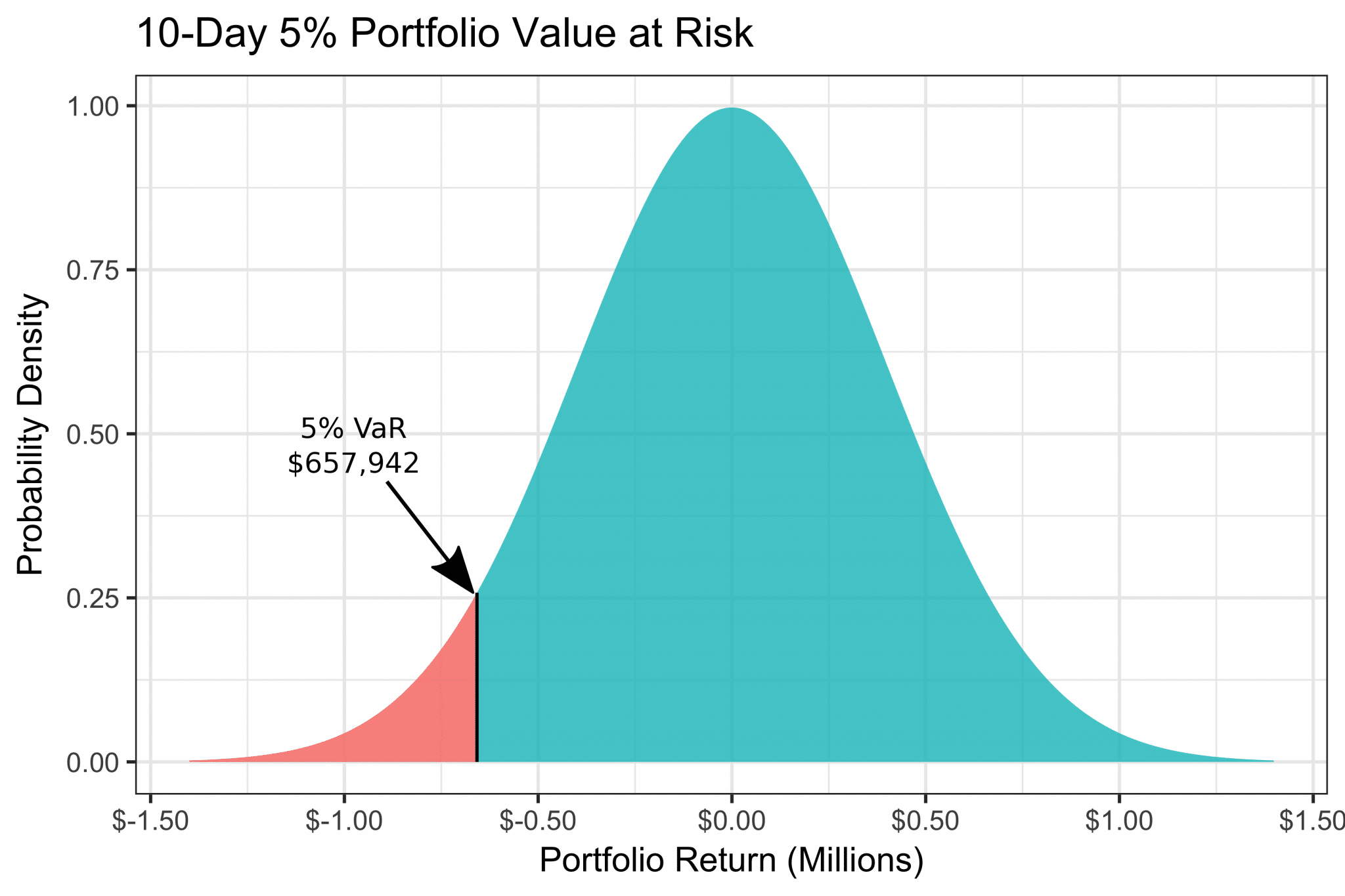

What is the worst loss my portfolio is likely to sustain over a specified period of time?

What is the current mark-to-market value of my portfolio?

How can I periodically monitor and report my portfolio’s VaR to ensure it remains below the limit specified by my organization’s risk policy?

How can I perform scenario analysis and stress testing to assess the effect of possible forward market moves on my portfolio’s value and risk?

How do contracts in my portfolio change in value as the underlying commodity prices move, i.e., what are my contract Greeks?

The Need for Analysis

VaR reporting has become commonplace in the energy and financial services industries due to the high degree of uncertainty in the future value of financial derivative positions. Companies with exposure to the energy markets often enter into derivatives positions to hedge against adverse changes in portfolio value, however, these positions themselves need to be monitored regularly as market conditions change. In fact, many regulatory agencies and organizational risk policies require such VaR reporting on a frequent basis.

robust VaR process reports contract-level MtM, VaR, and one or more of the “Greeks” that indicate the sensitivity of contract value to movements in the underlying commodity price. In addition, it should also report MtM and VaR for the portfolio as a whole, accounting for diversification, or the “canceling of risk”, between distinct positions. This is particularly important when assessing a portfolio where contracts have been implemented as hedges against adverse market moves.

For example, summing the individual contract VaRs will almost always overstate the overall portfolio risk because it assumes the worst case scenario occurs simultaneously for every single contract. In practice, however, short and long positions will offset each other and one commodity’s price may rise at the same time as another commodity’s price declines. These dynamics lead to portfolio diversification that must be properly captured and reported to give an accurate picture of an organization’s VaR exposure.

The cQuant.io Solution

cQuant’s VaR reporting solution computes and reports MtM and VaR at both the contract and portfolio level, and also reports individual contract Greeks. It leverages the latest market data to ensure the most up-to-date risk reporting possible as market conditions evolve, and employs the time-tested industry-standard methodology for computation outlined by Philippe Jorion in his seminal book on VaR.

With industry-approved methodology, concise reporting, an easy-to-use web interface, and affordable pricing plans, cQuant.io provides the VaR reporting solution your organization needs to keep pace with the ever-changing financial markets.

cQuant.io Users Can:

Report contract and portfolio-level VaR over a specified time horizon and at a specified confidence level for a portfolio of linear and nonlinear derivative contracts.

Report contract-level Greeks and MtM.

Drill down into portfolio-level results by asset, asset/deal type, counterparty, trader, commodity, and delivery period.

Easily monitor changes and trends in VaR and MtM through time.

Perform scenario analysis and stress testing on portfolio value and VaR.

Evaluate portfolio risk reduction value for prospective trades and hedges.