Renewable PPA Valuation

Business Questions

What is a fair value for a particular new or existing renewable power purchase agreement (PPA)?

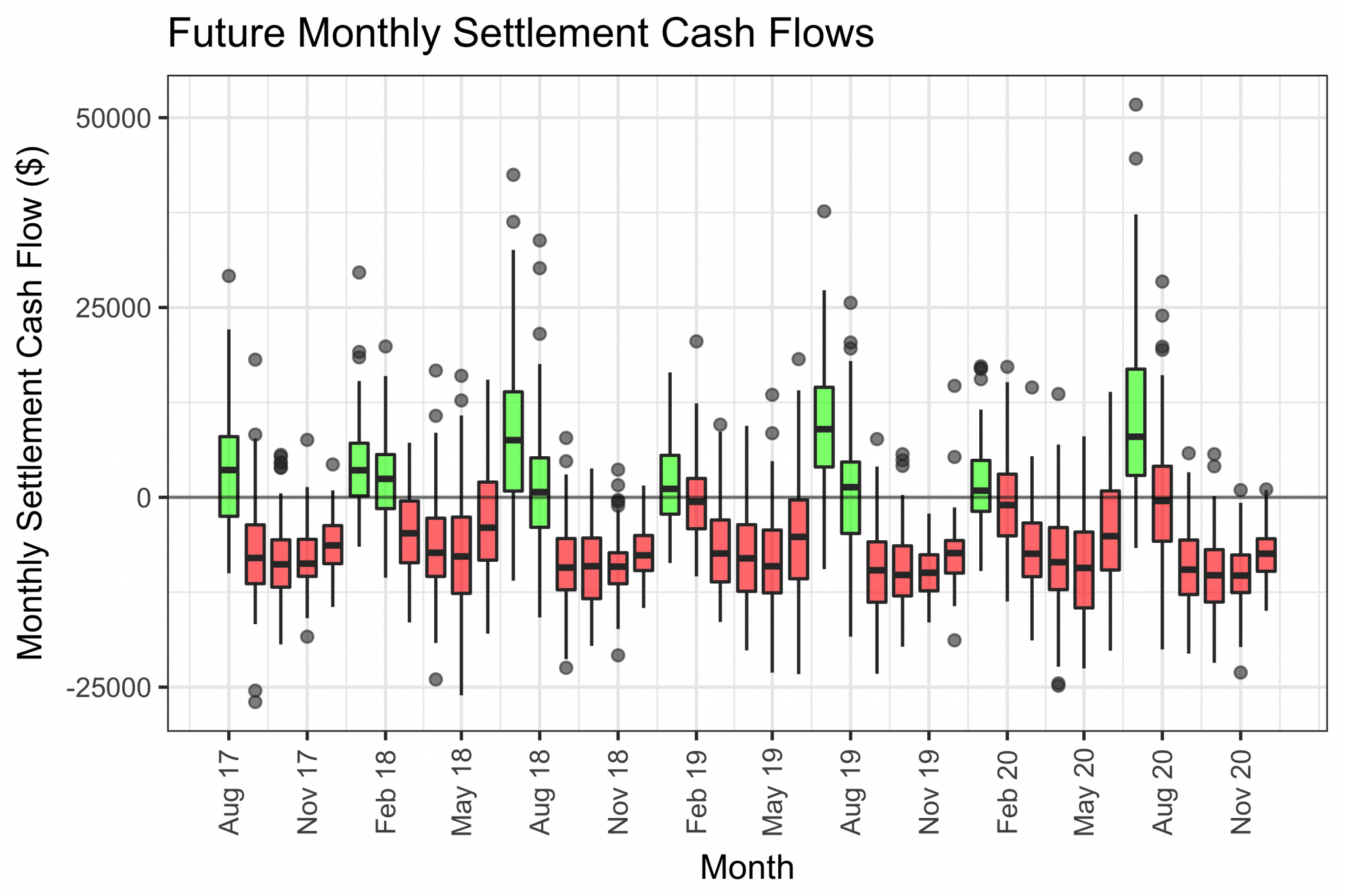

How might uncertainty in future renewable generation and electricity market prices impact my business’s cash flow after I sign the PPA?

What risk do I bear if current assumptions about the future state of the market don’t hold?

How can I easily track the mark-to-market (MtM) value of my PPA over time as market conditions evolve?

The Need for Analysis

Complex interactions between intermittent renewable generation and the real-time electricity market create uncertainty and risk for PPA counterparties. Valuing a PPA requires understanding the dynamic between a facility’s variable electricity production and the market price of that electricity. It also requires a thorough analysis of how sensitive the contract’s value is to changes in the expected future price of electricity, and how these changes might affect a purchaser’s future cash flow.

While the contracted PPA price is typically a fixed dollar amount for energy generated by a renewable facility, the real-time value of that energy is determined at the time of generation by the real-time electricity market price. Electricity prices are highly variable hour-to-hour and are affected by weather, unexpected supply outages, and even by renewable generation itself. Moreover, average electricity prices can change significantly year-over-year as generation supply assumptions and customer demand patterns evolve.

Wind and solar PPAs can be a great way for businesses to contribute sustainable green energy to the grid and display environmental stewardship by offsetting some of their carbon footprint. However, PPAs can have a significant negative impact a company’s balance sheet if their value and risk are not properly understood from the date of signing through the life of the contract.

The cQuant.io Solution

cQuant’s ReAssure PPA valuation model reports the true value of wind and solar electricity generated over the life of a PPA. It combines simulations of hourly electricity production with simulations of hourly electricity market prices, all at the precise geographic location of a particular renewable generation facility.

With robust analysis and intuitive reporting, cQuant.io’s ReAssure PPA helps ensure that PPAs remain assets, not liabilities, on your organization’s balance sheet.

cQuant.io Users Can:

Report current fair value of new and existing renewable PPAs based on hourly simulated production and market prices over the life of the contract.

Quickly re-run previous analyses against updated forward market prices to generate MtM reports for the PPA and track value over time.

Report expected monthly settlement cash flows and visualize uncertainty around the expected value.

Assess uncertainty in hourly production and value for each month of the year to inform targeted risk mitigation strategies.

Easily define scenarios on the expected future price of electricity and assess resulting impacts on PPA value and monthly settlement cash flows.