Market Forecasting Use Case

Business Questions

What is the expected power price for each hour and the expected natural gas price for each day of the coming year?

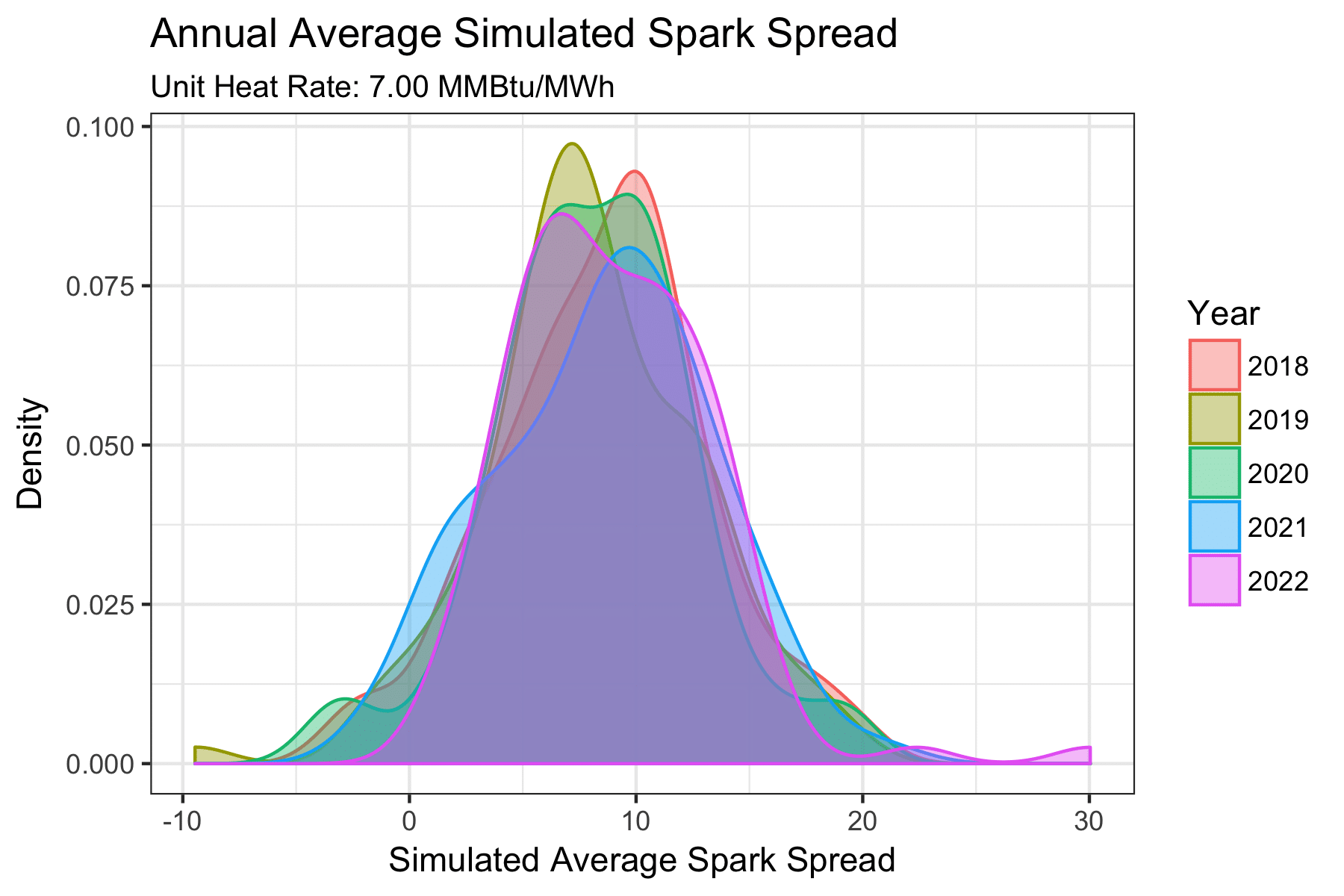

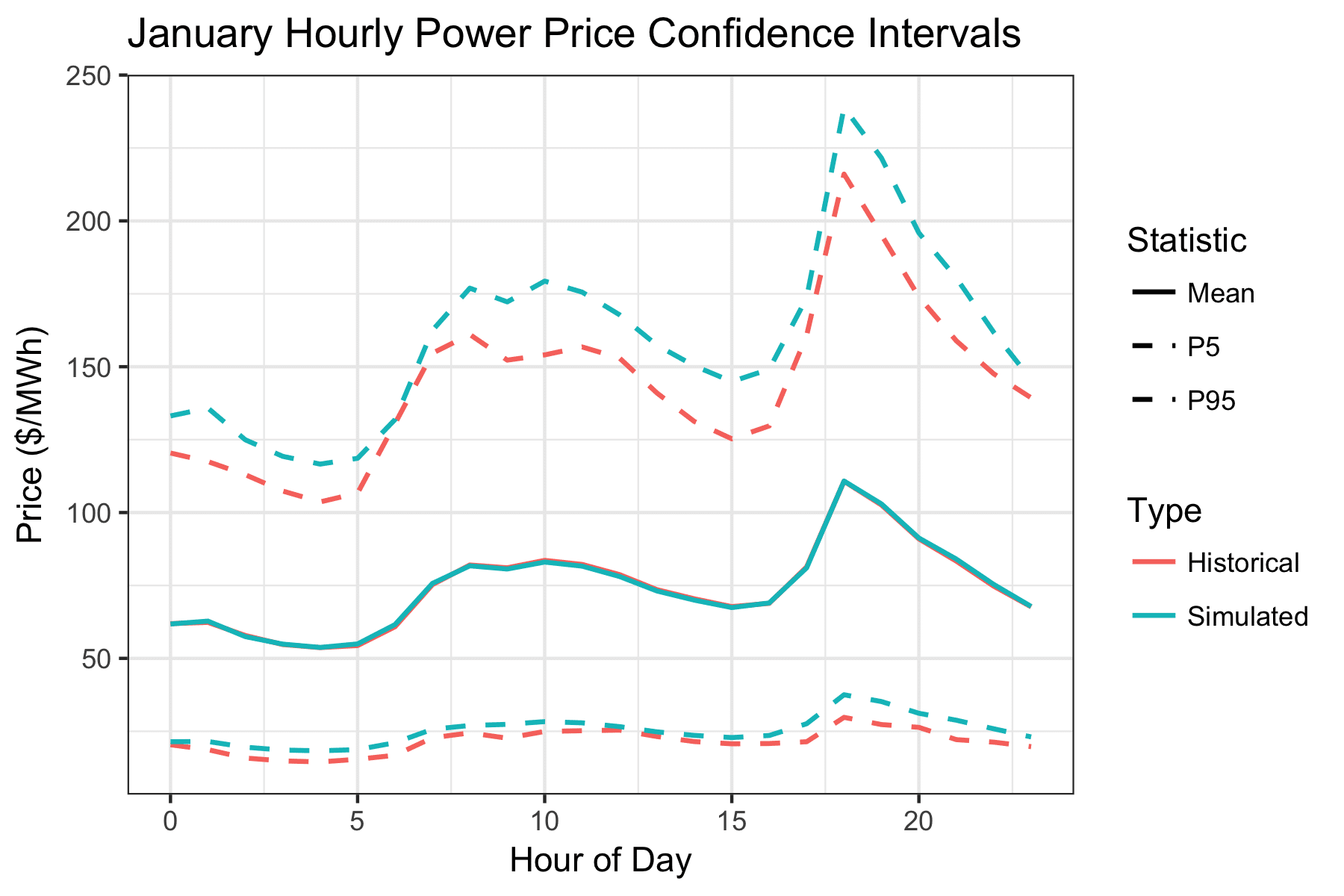

How much uncertainty is there around expected prices, and how does the degree of uncertainty vary by month of year, day of week, and hour of day?

How can I simulate daily and hourly energy commodity prices that reflect historical trends in price shape and uncertainty while still aligning with current forward market expectations?

What is a reasonable range of hourly market heat rates for a particular electricity LMP and natural gas hub over the coming year?

The Need for Analysis

Market prices for electricity, natural gas, and other energy commodities are notoriously fickle. With prices constantly pulled around in response to extreme weather, political decision-making and regulation, renewable generation, and many other market drivers, any price forecast is almost certain to be wrong. A truly valuable market forecasting tool must yield not only predicted future prices, but also an assessment of how uncertain the prediction is.

Because of the highly locational nature of market prices for electricity and natural gas, different price locations will also display different trends in seasonal, daily, and hourly uncertainty. For instance, electricity prices in western Texas may be likely to drop significantly on windy days because of the large amount of wind generation. However, in the Pacific northwest, downward price spikes are more likely to be caused by high river flows fueling the many hydroelectric generating stations.

Each of these price drivers contributes its own signature to both the expected price of power and the uncertainty around it. A good market forecasting tool must capture these signatures and ensure they are reflected in price simulations. It must also account for the relationships in price and uncertainty between different locations and even across different commodities.

The cQuant.io Solution

cQuant.io’s market forecasting framework generates Monte Carlo simulations of market prices that reflect historically-observed trends in uncertainty and maintain important correlations across distinct price locations and commodities, all down to the sub-hourly level. This makes the resulting forecasts ideal for predicting expected future prices, but also assessing the uncertainty around the predictions in a statistically robust way. Users can:

Any market prediction is only as good as the uncertainty bands around it. cQuant.io’s stochastic forecasting framework gives you a complete picture of the future state of the market, allowing you to prepare for the unexpected.

cQuant.io Users Can:

Generate Monte Carlo spot price simulations for power, natural gas, and other energy-related commodities down to the sub-hourly level.

Capture important trends in price uncertainty and cross-commodity correlations reflected in historical spot price data.

Understand not only the predicted future price, but also the full distribution of likely price outcomes.

Ensure risk neutrality between spot price simulations and currently forward market expectations.