Hedge Analysis

Business Questions

How can I assess the effectiveness and risk reduction value of individual hedges or collections of hedges within the context of my portfolio of physical and financial assets?

How will a prospective hedge affect my portfolio’s value at risk (VaR) and mark-to-market (MtM) value?

Which prospective hedge will provide the most cost-effective reduction in risk to my portfolio?

How can I use financial contracts to reduce risk for my physical generating assets, or vice versa?

The Need for Analysis

Physical energy generation asset owners, asset managers, and other energy market participants know that uncertainty in future prices of electricity and fossil fuels means risk exposure for their portfolio. An unhedged, or “naked”, portfolio exposed to today’s highly volatile energy market is a ticking time bomb. Unexpectedly hot or cold weather, new government regulations, or changes in global supply dynamics can quickly erode profits or even spell ultimate disaster for companies on the wrong side of the resulting price swings.

Financial contracts are the insurance policies of the energy and financial services industries. They can be used to lock in profits, guard against adverse market moves, and reduce overall portfolio risk. However, interactions between physical generating assets and the financial hedges that protect them, and even between distinct hedges themselves, can be complex.

The risk reduction benefit of a portfolio of hedges is not just the sum of the individual components. The relationships between price movements in the associated underlying commodities, or risk factors, are the real drivers of hedge effectiveness and risk reduction. Proper assessment of hedge effectiveness and risk reduction value requires statistical analysis and, ideally, simulation of future market prices.

The cQuant.io Solution

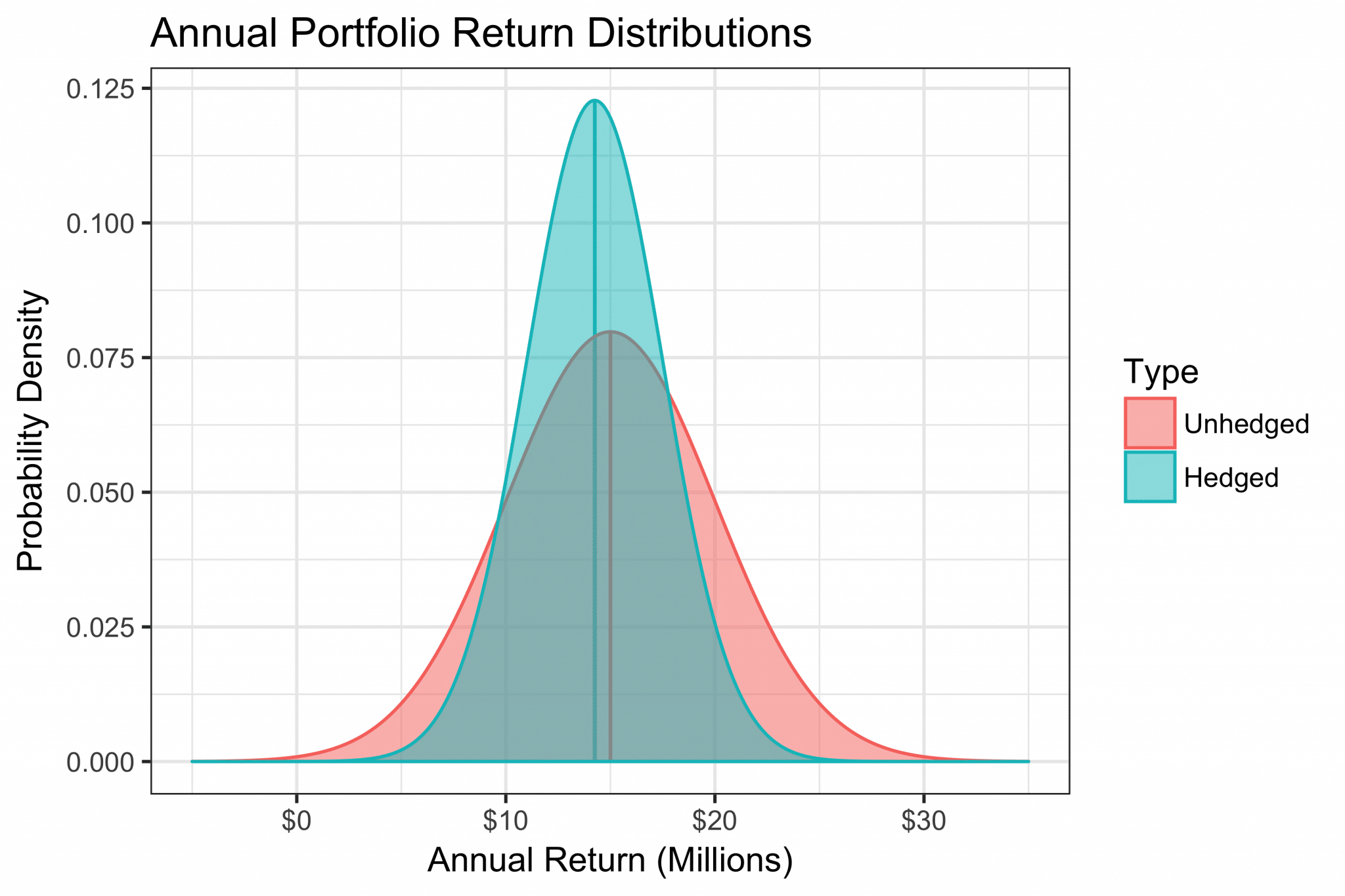

cQuant.io’s energy analytics platform includes several hedge analysis tools. Correlated Monte Carlo price simulations capture important relationships between risk factors, providing market-consistent hedge valuation and risk reduction reporting. Coincident optimal economic dispatch augments price simulations to value physical generation and energy storage assets within the same portfolio as financial contracts. VaR reporting allows users to assess contract and portfolio VaR, MtM, and various Greeks.

cQuant.io provides you with a robust set of analytical tools to analyze and optimize your hedging strategy. Targeted analysis and comprehensive reporting give you the insight and confidence you need to protect your portfolio from the volatile financial energy market.

cQuant.io Users Can:

Report expected future value and uncertainty in a hybrid portfolio of physical assets and financial contracts.

Easily perform sensitivity and scenario analysis by adding/removing hedges and adjusting trade quantities.

Compare prospective hedges to determine the optimal risk reduction strategy for a given portfolio.

Efficiently investigate portfolio-wide effects of scenarios and sensitivities on future market prices.

Quickly re-run past analysis with updated forward marks to assess portfolio-level deltas.