Power Purchase Agreements (PPAs): Can you manage?

The increase in power market volatility over the last few years combined with an acceleration of the renewable energy transition have placed Power Purchase Agreements (PPAs) at the center of everyone’s attention. PPAs have become the main contracting framework to stabilize uncertain future cash flows from new intermittent renewable generation resources (e.g., solar and wind) in order to secure financing for the physical projects and to offer buyers long-term supply of renewable energy and associated attributes.

Irrespective of the side of the PPA your company is on, the structure and negotiation of these deals has become increasingly complex due to many factors:

- Contractual stipulations embedded within PPAs have become more complex and increasingly nonlinear, making valuation more difficult.

- The mandate given to buyers is often to achieve aggressive sustainability targets (e.g. “70% of my energy comes from renewable sources.”)

- Negative covariance between renewable generation and power prices adds financial risk.

- Sourcing renewable energy for a flat load (e.g., datacenter) creates volumetric misalignment in supply and demand that can lead to increased exposure to volatile market prices.

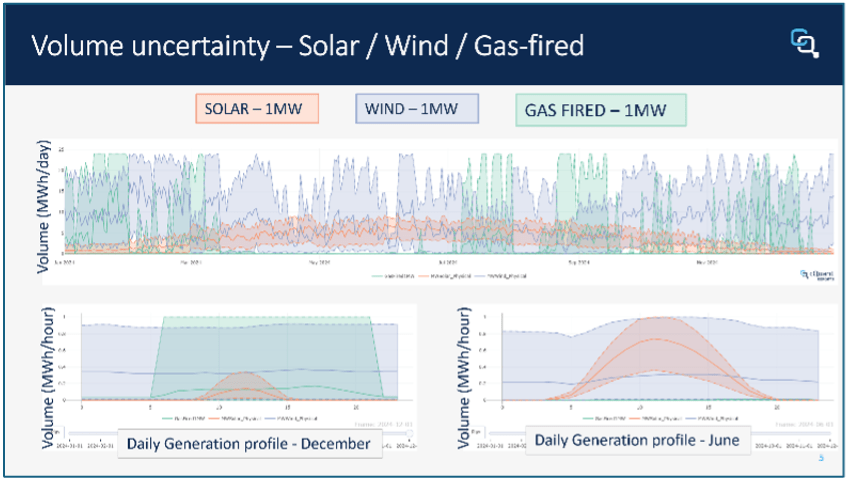

Volumetric uncertainty is one important consideration with renewable PPAs. The image above shows how equal installed capacity from 3 different generation technologies results in large discrepancies in production variability, load factor, and intra-day shaping.

Because valuation of a PPA is a complex exercise that requires detailed understanding of the hourly variation in market prices and generation as well as the correlated uncertainty between the two, it is useful to have a single metric to gauge PPA performance relative to the broader market. The PPA capture rate is one such metric, facilitating comparison across different PPAs and a benchmark of contract value relative to spot market power price activity. Capture rate is calculated as the generation-weighted average price (or, in the case of a PPA, the generation-weighted effective settlement price under the contract) divided by the flat-average price over the same period. A capture rate greater than one indicates the renewable asset or PPA is “beating” the market; a capture rate less than one indicates that value is less than a baseload (i.e., 7×24 block) contract for power.

The proper computation of a capture rate in the context of renewable assets or PPAs requires:

- Modeling the renewable generation properly. This is done using advanced statistical models that can properly represent the yearly seasonality, intra-day shaping, and intermittency in generation output.

- Modeling the hourly power prices. This is also done using advanced statistical models factoring in additional constraints such as fundamental market behaviors, market caps and floors, impact of generation stack evolution, locational basis impacts, and of course using the long-term market quotes and forecasts available.

- Accounting for the joint evolution of generation and power prices. Since the capture rate is essentially a sum product of renewable generation and power prices, we can use the simulated risk factors from the above point to derive a capture rate. However, the covariance between the two risk factors must be accurately represented – when renewable penetration is significant within the regional supply stack, this intermittent generation tends to drive power prices downward. Therefore, simulation paths in which renewable generation is high should generally correspond to low simulated market prices.

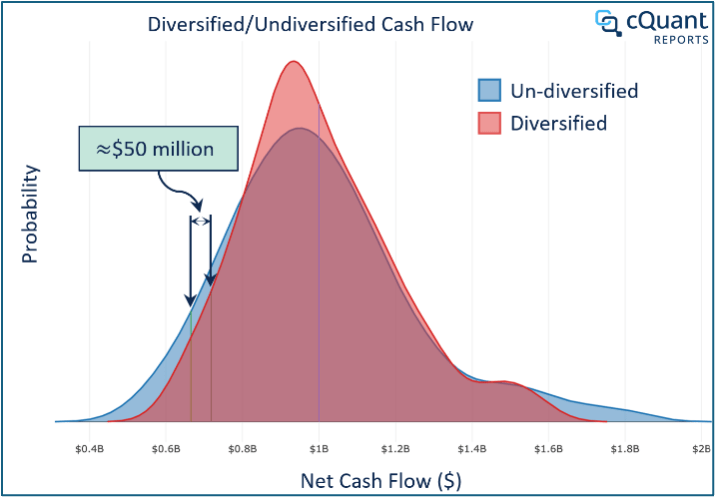

By properly accounting for these effects, we can also combine multiple physical assets, financial positions, and/or PPAs within a single portfolio, examining diversification and risk concentration effects that occur across the various components. As with analysis of individual PPAs, this portfolio-level analysis requires an analytical approach to accurately capture:

- Intraday shape (hourly/sub hourly)

- Yearly seasonality

- Covariance amongst jointly modeled risk factors

- Volatility

Through holistic portfolio-level simulation, we can construct optimally diversified mixes of assets and contracts, thereby reducing downside risk by the very structure of the portfolio itself.

Following from our strong modeling foundation, we want to identify which combination of renewable assets, batteries, and PPAs will perform well in extreme situations. A high renewable generation day likely means a low-price day and potentially an oversupply of energy to the portfolio. In such cases, surplus energy can be significant and may actually result in losses to the portfolio when prices are low. In the opposite scenario (low renewable generation/high prices), the portfolio may fall short of some precious MWh of supply, which must then be bought back from the market at high cost. To guard against these cases, one can optimize the portfolio mix in a few different ways:

- Building natively diversified portfolios. For example, diverse geographic exposure can reduce the likelihood of a bad day affecting all your assets simultaneously. Another example is a carefully balanced portfolio of diverse assets, such as a mix of wind, solar, and renewable PPAs, potentially spanning multiple markets.

- Building battery capacity to help flatten load exposure to the market and align supply and demand to reduce both long and short market exposure.

- Negotiating risk mitigation clauses embedded in your PPAs and pricing them accurately. Such clauses may include $0 settlement price floors, hub settlement provisions, basis buy-back triggers, and more.

At cQuant, we can help your commercial team, risk management team, and trading team achieve their goals.

- Our advanced quantitative models ensure you are not sacrificing accuracy or precision to model your portfolio of complex exposures.

- Our flexible valuation framework guarantees you won’t be caught in a situation where you can’t properly value a new asset or deal structure.

- cQuant’s trusted Analytics Platform delivers value to multiple business units simultaneously by leveraging collaborative analytical workflows and a broad suite of modeling capabilities.

Reach out to schedule a demo today and find out how cQuant can help you better navigate the energy transition.