Retail Rate Structures for Electric Distribution Networks in Transition: A Case for Automation

BY BROCK MOSOVSKY AND STEVEN DAHLKE

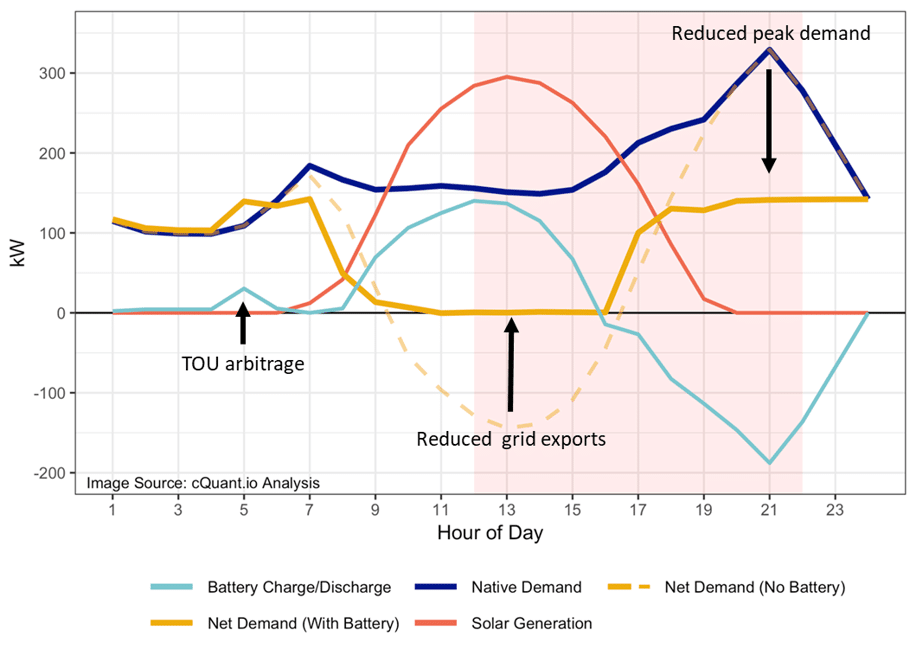

Clean energy technologies are increasingly being deployed on electric distribution systems and retail electricity pricing is evolving to support the transition. This evolution involves moving from rates characterized by flat energy charges and net metering policies for distributed energy resources (DERs) towards modern structures that more accurately reflect a utility’s costs to supply and deliver electricity. These include time-of-use schedules, demand charges, feed-in tariffs (FITs) for over-generation by DERs, and other dynamic pricing signals. These modern rate structures provide economic signals that encourage energy consumption during periods when supply is abundant and discourage consumption during periods when demand is higher and grid resources are more constrained.

Historically, net energy metering (NEM) policies have been the dominant compensation mechanism driving renewable DER growth in the United States, the large majority of which has been small-scale solar photovoltaics.(1) NEM requires utilities to compensate excess production from customer-owned generation at the relatively static retail electricity price. Under this paradigm, small-scale (<1MW) solar generation has grown an average of 27% per year from 2014-2018, and currently provides 33% of all solar energy in the United States.(2) Clearly, NEM policies have been an effective tool to stimulate early investment in distributed clean energy; however, policymakers have begun to shift away from this model for future distribution systems. (3)

NEM becomes less efficient as DER penetrations increase to substantial levels. As this occurs, the grid can become oversupplied with a particular form of generation (e.g., solar). This decreases the marginal value of each kilowatt-hour generated and increases grid management costs… read more here on page 5 of 44.

Article snippet from the IAEE Energy Forum – Third Quarter 2020. Issn 1944-3188. Full article found here.