Duck with a Side of Energy Storage: Why batteries pair perfectly with high-penetration solar

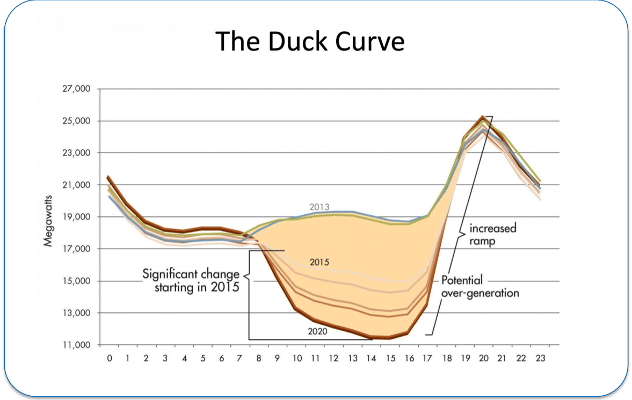

In 2013, the California Independent System Operator (CAISO) first published the iconic “Duck Curve“, forecasting what would happen to the shape of hourly net electricity demand under high solar photovoltaic (PV) penetration scenarios. Since this initial publication, the situation in California has unfolded in remarkably similar fashion to what was forecasted. Mid-day solar generation has dramatically reduced the net electricity demand that must be supplied by fossil-fueled power plants. However, the large amount of mid-day solar generation begins to ramp down exactly as the evening electricity peak is ramping up. This results in a more pronounced afternoon-to-evening ramp and puts added strain on the more traditional power plants that must be relied on to pick up solar’s slack after the sun sets. By helping to reduce the strain on these generators, adding batteries and other flexible generation resources to the grid can help support the integration of high levels of solar PV while maintaining reliable electricity supply. What is a bit less obvious at first glance is that this trend also holds in reverse: high levels of solar PV on the grid actually make it easier to integrate high levels of battery storage.

A recent report from the National Renewable Energy Laboratory (NREL) outlines exactly why this is the case. Essentially, batteries are great at providing power over short timeframes but less ideal for maintaining high power output over long periods of time. Put another way, batteries are well-suited to deliver power but are less adept at delivering energy. As increased solar penetration levels reduce system net demand on the front-end of the evening peak, the overall system peak in net demand becomes “sharper”. That is, the highest levels of electricity demand persist for a shorter amount of time than in the absence of solar generation. This allows batteries to more easily provide peak reduction benefits to the grid because they can discharge for a shorter period of time while achieving the same reduction in overall system peak demand.

“Those that fail to leverage today’s ever-more-accessible data analytics to monitor their portfolios amid a changing market may find themselves eating crow while the rest of the industry sits down to duck.”

The overall dynamic between solar and batteries, as the authors note, is one of synergism. In the language of system dynamics, it’s a reinforcing feedback loop. Increases in battery storage and flexible generation on the grid allow more solar to be integrated, which in turn increases the value proposition of battery storage and flexible generation. That is, batteries are good for renewable energy is good for batteries–and round and round we go.

There’s also a third component to this dynamic that the NREL report doesn’t really address: market prices. To-date, the Duck Curve has already lead to decreases in the mid-day price of electricity in California, with marginal wholesale electricity prices frequently even dipping below zero. This means that generators (regardless of type) that put electricity onto the grid may actually have to pay to do so. In two recent articles, we discussed how the net load dynamic that results from high levels of renewable generation is killing the economics of the baseload operational paradigm where large centralized generators run at constant output for long periods of time. However, battery storage has the unique ability to increase both electricity production and electricity consumption on the grid, albeit at different times. If properly scheduled, the increased electricity demand from batteries could become a powerful stabilizing force for both the electricity demand curve and, correspondingly, for market prices.

As the grid transforms and market expectations evolve, we are likely to see dramatic shifts in what becomes “normal” for wholesale electricity market prices. Stabilization of the hourly shape of electricity demand could mean reduced energy prices and less market volatility. Organizations with physical assets or long-term power purchase agreements could see the erosion of value in their existing assets and contracts. Load serving entities could find it more economically optimal to purchase power on the spot market than to fire up aging generators, forcing these units into early retirement.

Whatever these fundamental shifts in electricity supply will bring, businesses with a stake in the game should carefully monitor the value of their assets and actively pursue downside protection through targeted risk mitigation strategies. Those that fail to leverage today’s ever-more-accessible data analytics to monitor their portfolios amid a changing market may find themselves eating crow while the rest of the industry sits down to duck.

Brock Mosovsky, Ph.D., is Director of Operations and Analytics at cQuant.io, a SaaS energy analytics platform that helps companies understand their physical and financial exposure in today’s energy markets.

Need a solution for your energy analytics? We can help!

Request your free demo today.